Schedule a Visit

Regardless of whether you require general advice or specific support, we are happy to help you.

Regardless of whether you require general advice or specific support, we are happy to help you.

All News

Share

The global lab-grown diamond market will reach $91.85 billion by 2034, growing at 13.42% annually. This growth depends entirely on manufacturing equipment capable of synthesizing diamonds and processing them to specification.

Selecting the right lab diamond machine requires understanding two distinct technology categories: synthesis equipment that grows diamonds from carbon, and laser processing systems that cut, grind, and finish them to final dimensions. Most manufacturers need both. The synthesis methods—HPHT and CVD—produce rough crystals that require precision machining traditional tools can’t handle.

This guide covers technical specifications, cost structures, and supplier evaluation criteria based on actual equipment performance data. If you’re evaluating lab diamond machine investments, the information here comes from documented installations across aerospace, medical device, and cutting tool manufacturing sectors where OPMT has deployed 5-axis laser processing systems specifically engineered for superhard materials.

Two synthesis methods dominate industrial diamond production: HPHT (High Pressure High Temperature) and CVD (Chemical Vapor Deposition). They produce diamonds through different mechanisms and serve different applications.

HPHT machines replicate geological formation conditions. Pressures exceed 5 GPa—that’s 50,000 atmospheres. Temperatures reach 1,300-1,600°C. The equipment uses belt-type, cubic anvil, or split-sphere press configurations depending on target production volume and crystal size. Metal catalysts (typically Ni-Mn-Co or Fe-based alloys) dissolve carbon and facilitate diamond crystallization on seed crystals.

CVD reactors grow diamonds at lower pressures through plasma-enhanced chemical deposition. Temperature ranges from 800-1,200°C in controlled vacuum chambers. Microwave or hot-filament energy sources crack methane-hydrogen gas mixtures into reactive carbon species that deposit onto diamond seeds atom by atom. The process is slower but offers superior control over crystal properties.

HPHT excels at producing industrial-grade diamonds for cutting tools. Yield efficiency runs 85-95% with growth cycles of 5-20 days. The diamonds emerge small but consistent—ideal for abrasive applications and PCD tooling where size uniformity matters more than optical properties.

CVD enables larger high-purity crystals. Growth rates are slower (0.1-10 μm/hour) but the method produces Type IIa diamonds with better color consistency and fewer nitrogen impurities. This makes CVD the preferred choice for gemstone applications and specialized industrial uses requiring specific thermal or electronic properties.

Equipment selection depends on your target market. HPHT for rapid industrial diamond production where speed and cost matter most. CVD for premium gemstone quality and applications requiring Type IIa purity specifications. Understanding the detailed comparison between HPHT and CVD production methods helps manufacturers match technology to their specific application requirements.

Both methods produce rough diamonds requiring precision laser post-processing. Neither synthesis method delivers finished products—you need machining equipment to achieve final geometry, surface quality, and dimensional tolerances.

Understanding what’s inside these machines helps you evaluate supplier claims and maintenance requirements.

HPHT press systems need hydraulic capacity to generate 50,000-65,000 atmospheres consistently. That’s not a small pump—these are high-capacity industrial hydraulic systems with precision temperature control and metal catalyst chambers. The catalyst system is critical: Ni-Mn-Co or Fe-based alloys must maintain specific composition ratios or diamond quality degrades.

CVD reactors integrate MPCVD (Microwave Plasma Chemical Vapor Deposition) systems with gas management infrastructure. Methane-hydrogen mixtures require flow control accuracy within 1-2% to maintain stable plasma conditions. Vacuum pump assemblies maintain base pressure around 10^-6 torr—any leak degrades diamond quality or prevents growth entirely. Plasma generation operates at 2.45 GHz frequency with power levels from 5-150 kW depending on chamber size.

Growth chamber design incorporates diamond seed mounting platforms with multi-point temperature monitoring. Process gas distribution manifolds must deliver uniform flow across the substrate area. Contamination control systems meet cleanroom standards because even trace impurities affect diamond properties.

Advanced reactors feature real-time monitoring tracking growth rates, temperature uniformity (±5°C across substrate), and optical emission spectroscopy for process control. These aren’t optional features—you need this data to optimize yield and maintain consistent quality batch to batch. Recent advances in microwave plasma technology for CVD diamond production have improved growth rate consistency and reduced defect formation.

Equipment footprint ranges from 10m² for entry-level systems to 50m² for industrial-scale CVD facilities with multiple reactor chambers. Plan for utility requirements: 480V three-phase power, chilled water capacity (typically 50-100 kW cooling load), and process gas storage (methane, hydrogen, argon cylinders or bulk tanks for high-volume operations).

Synthesis is half the process. Diamonds emerge from HPHT presses or CVD reactors as rough crystals requiring cutting, grinding, and surface finishing to specification.

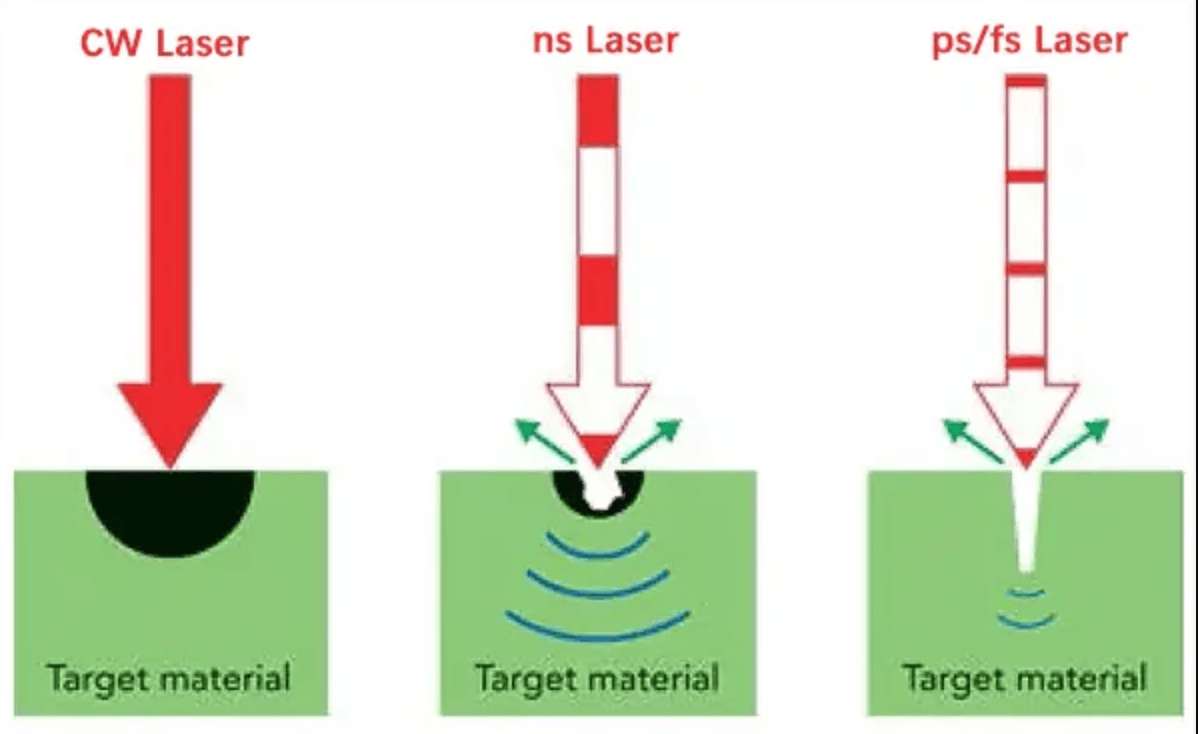

Traditional mechanical methods fail on superhard materials. Diamond has Mohs hardness 10—nothing else will cut it efficiently except other diamonds or advanced laser systems. This is where precision laser processing becomes essential.

5-axis laser machining centers like OPMT’s Light 5X 40V and Light 5X 60V deliver ±0.003mm positioning accuracy with 120° B-axis swing angles. These specifications enable complex geometric processing for PCD, CVD diamond, and CBN materials that other systems can’t handle. The 5-axis capability matters because diamond cutting tools require compound angles and radiused edges—3-axis systems can’t produce these geometries.

Specialized CVD diamond surface processing systems take different approaches. The DiaCUT L315V features 532nm wavelength lasers with 0.01mm positioning accuracy and 0.002mm repeat positioning accuracy for gemstone-quality surface finishes. That’s green laser wavelength specifically chosen for optimal absorption characteristics in diamond material.

Dual-laser grinding configurations like the LightGRIND LT20 achieve 0.3-0.5μm removal rates. Marble machine beds provide thermal stability during long grinding cycles. Capacity to process up to 22 pieces simultaneously on 400mm turntables makes sense for production environments where throughput determines profitability.

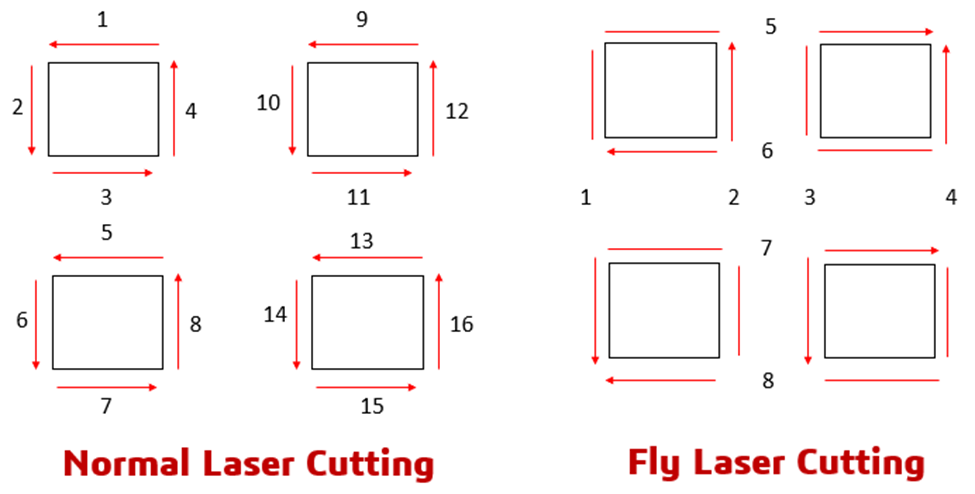

Laser processing delivers 3x faster production speeds compared to EDM, 53% lower operating costs, and zero chemical waste through non-contact processing methodology. These aren’t marketing claims—they’re measured results from facilities running both technologies side by side. The comparison between lab-grown diamond machines and traditional methods demonstrates these performance advantages across different material types and production volumes.

Synthesis and finishing equipment must work together. Integrated production lines connect synthesis equipment with laser processing systems through automated material handling and quality inspection stations.

Process flow sequences diamond growth chamber output through laser cutting for initial sizing. Rough diamonds get sorted by size and quality grade, then routed to appropriate processing stations. 5-axis contouring handles complex geometries. Precision grinding achieves surface finish specifications. Final inspection uses laser interferometer calibration to verify dimensional accuracy.

CCD positioning cameras and high-precision probes enable automated measurement throughout the workflow. This matters for traceability—you need to track individual diamond batches from seed crystal through final product with full documentation.

Manufacturing execution systems (MES) coordinate synthesis parameters with downstream processing schedules. When a CVD reactor completes a growth cycle, the MES automatically schedules laser processing time based on current queue depth and priority assignments. This level of integration reduces inventory holding time and improves equipment utilization rates.

Quality assurance protocols integrate optical emission spectroscopy during growth with post-processing measurement systems. Dimensional accuracy, surface roughness (Ra < 0.1μm achievable), and crystallographic orientation all get verified against specifications. Advanced lab-grown diamond processing techniques integrate real-time monitoring with adaptive process control to maintain quality across production runs.

Advanced facilities implement RTCP (Rotation Tool Center Point) 5-axis linkage capabilities with closed-loop grating scale detection. This ensures highest positioning accuracy across the complete production workflow—critical when tolerances measure in microns and material costs are high.

Equipment costs vary significantly based on configuration, automation level, and throughput capacity.

Capital equipment costs range from $125,000-$500,000 for CVD reactors depending on chamber size and automation features. Larger chambers grow more diamonds per cycle but require proportionally higher power and cooling capacity. Laser processing systems add $200,000-$800,000 for 5-axis configurations.

Monthly operating costs for integrated systems total approximately $1,296 for laser processing—that’s a 63% reduction versus traditional methods. This breaks down to electrical consumption (400 yuan vs 720 yuan traditional), minimal consumables (laser systems don’t wear grinding wheels), and reduced cooling requirements (80 yuan vs 320 yuan for conventional grinding).

ROI calculations demonstrate 8-14 month payback periods for laser processing systems based on 200-300% throughput improvements and 40-50% energy efficiency gains. Elimination of consumable grinding materials matters more than many buyers expect—diamond grinding wheels cost $500-2000 each and wear rapidly when processing superhard materials.

Total cost of ownership analysis must include infrastructure beyond equipment purchase price. Facility upgrades for three-phase power distribution. Cleanroom compliance if producing optical-grade diamonds. Utility capacity expansion for chilled water systems. Training programs for operations personnel—synthesis and laser processing both require specialized knowledge.

Economic advantages compound through quality risk mitigation. Lower rework rates. Reduced rejection percentages. Warranty exposure reduction when you can verify dimensions and surface finish before shipping. Competitive positioning through technology leadership that enables premium pricing. The comparison between CVD and HPHT laser processing optimization shows how different synthesis methods affect downstream processing costs and efficiency.

Supplier selection determines long-term success as much as equipment specifications.

Leading suppliers include OPMT Laser for integrated laser processing solutions, Applied Diamond Inc. specializing in CVD technology, Ningbo Crysdiam Technology with 1,500+ MPCVD reactors deployed globally, and SLTL Group’s Hallmark Labplus for CVD-specific processing equipment. When evaluating lab diamond machine suppliers, technical capabilities should drive the decision rather than initial purchase price alone.

Evaluation criteria should prioritize technical capabilities first. Positioning accuracy specifications—verify these with actual measurement data, not brochure claims. Material compatibility across your target product range. Throughput capacity under realistic production conditions, not best-case laboratory demonstrations.

After-sales support infrastructure matters more than buyers typically realize. Training programs that cover both theory and hands-on operation. Technical documentation quality—can your maintenance team troubleshoot issues using provided manuals? Spare parts availability with documented lead times. Response protocols for critical failures that halt production.

Compliance certifications indicate engineering rigor. ISO standards. Pressure vessel safety certifications for HPHT equipment. CE marking for European installations. These aren’t bureaucratic obstacles—they’re evidence of proper design validation.

Supplier financial stability and R&D investment indicate long-term technology roadmap alignment. Manufacturers with 50+ patents demonstrate innovation commitment and technical depth. This matters because equipment will operate 10-15 years—you need a supplier who’ll still exist and support their products throughout that lifecycle.

Geographic considerations affect lead times, installation support, and ongoing service response. Regional suppliers may offer advantages for training and maintenance despite potentially higher initial costs. Calculate total support costs over equipment lifetime, not just purchase price.

Reference installations provide validation of claimed performance specifications. Request site visits to operational facilities processing similar diamond types and production volumes. Talk to current customers about actual uptime percentages, maintenance requirements, and supplier responsiveness.

Market growth drives equipment demand and influences technology development priorities.

The global lab-grown diamond market will grow from $29.46 billion in 2025 to $91.85 billion by 2034 at 13.42% CAGR. Lab-grown diamonds captured 21% of total diamond market share in 2025—that percentage will increase as production costs decline and quality consistency improves.

Asia-Pacific leads growth at 24% CAGR from 2026-2033. Manufacturing expansion in China, India, and Japan reflects increasing local equipment production capabilities that reduce costs. Chinese CVD reactor manufacturers now compete effectively with Western suppliers on technical specifications while offering 30-40% lower prices.

CVD technology experiences fastest growth at 21.8% CAGR due to advantages producing larger high-purity crystals. Better color consistency matters for jewelry applications where buyers expect colorless or near-colorless grades. HPHT will continue dominating industrial applications but CVD gains market share in premium segments.

Industrial applications drive 22.5% CAGR in specialized segments. Semiconductor manufacturing requires specific thermal conductivity properties. Precision cutting tools need particular grain structures. Advanced electronics applications require Type IIa diamond with minimal nitrogen content. These technical requirements favor CVD synthesis methods. Understanding CVD diamond reactor technology and applications helps manufacturers anticipate future equipment requirements.

Technology evolution focuses on automation integration. MES systems connecting synthesis with processing. Industry 4.0 protocols enabling predictive maintenance. AI-powered process optimization for growth parameters that maximize yield while minimizing defects. Hybrid systems combining synthesis with in-line laser processing to reduce cycle times and material handling.

Equipment capabilities matter less than operational execution in determining profitability.

Successful implementation requires phased validation programs using representative materials under production conditions. Start with sample processing before full-scale deployment. Test your specific diamond types and geometries. Verify that claimed specifications hold up under sustained production runs, not just demonstration cycles.

Operator training programs must cover both synthesis fundamentals and laser processing techniques. Pressure/temperature parameters and their effects on diamond quality. Gas management procedures including safety protocols for hydrogen handling. Catalyst systems and their maintenance requirements. Laser processing toolpath programming. Fixture design for complex geometries. Quality inspection procedures with proper measurement equipment.

Preventive maintenance schedules should address critical components systematically. Vacuum pump systems require quarterly service—neglect this and diamond quality degrades before you notice. Laser source calibration semi-annually maintains power output specifications. Mechanical positioning system verification monthly catches wear before it affects accuracy.

Process documentation enables continuous improvement through parameter tracking. Record growth rates, energy consumption, yield percentages, and quality metrics for statistical process control. This data identifies optimization opportunities and establishes baseline performance for troubleshooting when issues arise.

Environmental compliance considerations include proper ventilation for process gases. Hydrogen and methane both require explosion-proof electrical systems and proper leak detection. Hazardous material handling protocols for metal catalysts—some contain cobalt or nickel compounds with specific disposal requirements. Energy management strategies to optimize utility consumption during 24/7 reactor operations.

Manufacturing lab-grown diamonds requires synthesis equipment to grow crystals and laser processing systems to finish them. HPHT produces industrial diamonds rapidly. CVD enables premium crystals with superior optical properties. Both need precision laser machining for final geometry and surface quality.

Equipment selection depends on target applications, production volumes, and quality specifications. Capital costs range from $325,000-$1,300,000 for integrated systems. Operating costs favor laser processing with 63% reductions versus traditional methods. ROI typically occurs within 8-14 months based on throughput improvements and energy efficiency gains.

Supplier evaluation should prioritize technical capabilities, support infrastructure, and long-term viability over initial purchase price. Market growth at 13.42% CAGR through 2034 will drive continued equipment innovation focused on automation, process optimization, and hybrid manufacturing approaches.

OPMT specializes in 5-axis laser machining centers specifically engineered for lab-grown diamond post-processing, integrating ultrafast laser technology with CNC precision to deliver ±0.003mm positioning accuracy for superhard materials across aerospace, medical device, and cutting tool manufacturing applications.

Disclaimer

This content is compiled by OPMT Laser based on publicly available information for reference only; mentions of third-party brands and products are for objective comparison and do not imply any commercial association or endorsement.

Compare picosecond vs nanosecond laser systems for industrial manufacturing. HAZ data, processing speeds, cost analysis, and application criteria from OPMT’s deployed systems.

PCD laser cutting machines deliver 0.003mm accuracy and 3x faster processing than EDM. Complete technical guide to polycrystalline diamond tool manufacturing for aerospace and automotive industries.

Fly cut laser technology reduces cycle time by 30-50% through continuous motion path optimization. Learn mechanics, applications, and OPMT equipment specifications for precision manufacturing.

Factory evaluation frameworks for laser cutting equipment procurement. Infrastructure assessment, quality systems analysis, and total cost of ownership calculations based on 30+ facility audits.

Please fill in your contact information to download the PDF.