Vereinbaren Sie einen Besuch

Egal ob Sie eine allgemeine Beratung oder spezifische Unterstützung benötigen, wir helfen Ihnen gerne weiter.

Egal ob Sie eine allgemeine Beratung oder spezifische Unterstützung benötigen, wir helfen Ihnen gerne weiter.

Alle News

Aktie

Der Markt für 5-Achs-CNC-Bearbeitungszentren bietet attraktive Chancen für kleine und mittlere Unternehmen (KMU), die sich durch präzise Fertigung Wettbewerbsvorteile sichern wollen. Moderne vertikale Bearbeitungssysteme erreichen heute eine Genauigkeit im Mikrometerbereich, die bisher Großbetrieben vorbehalten war. Hersteller, die eine korrekte Implementierung vornehmen, berichten von Kostensenkungen (22-28%) innerhalb von drei Jahren nach der Inbetriebnahme. Dieser Investitionsleitfaden untersucht budgetgerechte Systeme von $125.000 bis $500.000 und bietet Entscheidungshilfen zur Maximierung der Kapitalrendite in Produktionsumgebungen mit einer jährlichen Stückzahl von 10.000 bis 50.000.

Der globale Markt für 5-Achs-CNC-Bearbeitungszentren weist ein starkes Wachstum auf. Bis 2027 wird ein durchschnittliches jährliches Wachstum von 8,91 Milliarden US-Dollar prognostiziert, was zu einem Marktwertzuwachs von 875,4 Millionen US-Dollar führen wird. Dieses Wachstum kommt insbesondere kleinen und mittelständischen Herstellern zugute, da technologische Fortschritte die Kosten für die Ausrüstung senken und gleichzeitig die Leistungsfähigkeit verbessern. Der Markt erreichte 2024 ein Volumen von 4,04 Milliarden US-Dollar und wird bis 2026 voraussichtlich auf 4,14 Milliarden US-Dollar anwachsen. Nordamerika trägt mit über 701 Milliarden US-Dollar zur regionalen Nachfrage bei, die durch den Bedarf an Präzisionsbauteilen in der Luft- und Raumfahrt sowie der Automobilindustrie getrieben wird.

Die Investitionsstufen für kleine bis mittlere Fabriken lassen sich in drei Kategorien einteilen, die sich nach Produktionsvolumen und Komplexität richten. Einstiegssysteme ($125.000–$200.000) eignen sich für Lohnfertiger und Bildungseinrichtungen, die vielseitige Bearbeitungsmöglichkeiten ohne fortgeschrittene Automatisierungsfunktionen benötigen. Anlagen der mittleren Preisklasse ($200.000–$350.000) sind für Hersteller konzipiert, die Mischchargen bearbeiten und dabei erhöhte Genauigkeit und thermische Stabilität erfordern. Premiumsysteme ($350.000–$500.000) bieten Präzision auf Luft- und Raumfahrtniveau mit integrierter Automatisierung und sind für die Serienfertigung geeignet.

Amortisationszeit-Benchmarks legen klare Leistungsschwellen für die Rechtfertigung von Ausrüstung für KMU fest. Investitionen, die sich innerhalb von zwei Jahren amortisieren, gelten als exzellent. Dies ist typischerweise der Fall, wenn Hersteller margenstarke, zuvor ausgelagerte Aufträge umstrukturieren oder neue Aufträge gewinnen, die 5-Achs-Bearbeitung erfordern. Gute Investitionen weisen Amortisationszeiten von 2–3 Jahren durch reduzierte Rüstzeiten und Einsparungen bei den Lohnkosten auf. Dies ist das häufigste Szenario für Fabriken mit einer Jahresproduktion von über 10.000 Teilen. Strategische Investitionen mit einer Laufzeit von 3–5 Jahren erfordern eine überzeugende Begründung durch Kapazitätserweiterungen oder die Erreichung von Marktpositionierungszielen anstelle unmittelbarer operativer Verbesserungen.

OPMT Light 5X 40V Die Light 5X 40V ist eine spezialisierte Lösung für die vertikale Laserbearbeitung mit NUM-CNC-Steuerung und einer Positioniergenauigkeit von 0,005 mm, die sich durch ihre wettbewerbsfähigen Preise im KMU-Bereich auszeichnet. Das System nutzt Linearmotoren für die X-, Y- und Z-Achse in Kombination mit drehmomentmotorgetriebenen B- und C-Rotationsachsen und erreicht so eine Wiederholgenauigkeit von 0,003 mm für Anwendungen mit PCD-, PCBN- und CVD-Hochleistungsmaterialien. Mit Verfahrwegen von 400 mm in der X-Achse, 250 mm in der Y-Achse und 300 mm in der Z-Achse verarbeitet die Light 5X 40V Werkzeugdurchmesser bis zu 200 mm in speziellen Konfigurationen und benötigt dabei nur eine Stellfläche von 1700 x 1900 mm sowie eine elektrische Leistung von lediglich 23 kVA. Die integrierte GTR-Schneidwerkzeugsoftware ermöglicht eine schnellere Programmierung (80%) im Vergleich zu herkömmlichen EDM-Verfahren, was insbesondere für die Elektronik- und Präzisionswerkzeugindustrie von Vorteil ist.

Die Haas UMC-500 setzt den Branchenstandard für den Einstieg in die 5-Achs-Bearbeitung in kleinen und mittleren Unternehmen. Die Preise für die Basiskonfigurationen liegen zwischen $125.000 und $150.000, die voll ausgestatteten Varianten mit fortschrittlichen Messtaster- und Hochgeschwindigkeitsspindeloptionen zwischen $175.000 und $200.000. Das System bietet Verfahrwege von 610 mm in der X-, 406 mm in der Y- und 406 mm in der Z-Achse sowie eine Spindeldrehzahl von 8.100 U/min und eignet sich für allgemeine Fertigungsanwendungen. Haas' Direktfertigungsmodell und die hauseigene Komponentenproduktion tragen zu einer hohen Zuverlässigkeit bei und machen die UMC-500 besonders geeignet für Betriebe, die ohne hohes Investitionsrisiko von 3- auf 5-Achs-Bearbeitung umsteigen.

Die Mittelklasse-Lösungen von DMG MORI und Mazak erreichen Toleranzen von ±0,0002 Zoll (±0,005 mm) durch Direktantriebsmotoren und Hochgeschwindigkeitsspindelkonfigurationen, die für Anwendungen in der Luft- und Raumfahrt sowie der Automobilindustrie optimiert sind. Die Mazak Variaxis 500 repräsentiert diese Kategorie mit einer Gesamtinvestition von $305.000 bis $475.000, inklusive Installation, Werkzeugen, Schulung und CAM-Software. Der modulare Spindelkonfigurationsansatz von DMG MORI ermöglicht aufgabenoptimierte Aufspannungen für ein breites Materialspektrum von Aluminium bis Titanlegierungen und positioniert diese Systeme als umfassende Lösungen zur Produktivitätssteigerung in der Mehrachsenbearbeitung. Die Amortisationszeit für Lohnfertigungsanwendungen beträgt typischerweise 2–3 Jahre, basierend auf reduzierten Rüstzeiten und erweiterter Leistungsfähigkeit.

Die Okuma GENOS M560V-5AX erreicht eine Wiederholgenauigkeit von ±0,001 mm durch thermische Stabilitätstechnik und die Machining Navi Mg-Technologie zur optimalen Bestimmung der Bearbeitungsparameter. Die Preise liegen je nach Konfiguration zwischen 120.000 und 700.000 TP4T. Die GENOS-Serie richtet sich an wachsende Hersteller, die hohe Leistungsfähigkeit ohne Premium-Investitionen benötigen. Das Wärmemanagement des Systems ist auf Anwendungen in der Schwerindustrie und der Luft- und Raumfahrt ausgerichtet, wo die Maßhaltigkeit über lange Produktionsläufe hinweg höhere Anfangsinvestitionen rechtfertigt.

| System | Preisklasse | Positionierungsgenauigkeit | Grundfläche | Arbeitsbereich | Zielanwendung | Jährliche Betriebskosten |

|---|---|---|---|---|---|---|

| OPMT Light 5X 40V | $150K-$250K | 0,005 mm | 1700 x 1900 mm | 400 x 250 x 300 mm | Schneidwerkzeuge, 3C-Elektronik | $40K-$50K |

| Haas UMC-500 | $125K-$200K | ±0,005 mm | Kompakt vertikal | 610 x 406 x 406 mm | Allgemeine Fertigung, Lohnfertigungsbetriebe | $45K-$60K |

| Mazak Variaxis 500 | $305K-$475K | ±0,0002 Zoll | Standard-Fußabdruck | Mittlere Kapazität | Automobilindustrie, Medizinprodukte | $45K-$65K |

| DMG MORI 5-Achsen | $200K-$1M | ±0,005 mm | Variable | Anwendungsspezifisch | Luft- und Raumfahrt, Automobil | $50K-$75K |

| Okuma GENOS M560V | $120K-$700K | ±0,001 mm | Verbesserte Wärmemanagement | Anwendungsoptimiert | Schwerindustrie, Luft- und Raumfahrt | $55K-$85K |

Die Formel für die Gesamtbetriebskosten (Total Cost of Ownership, TCO) ermöglicht eine umfassende Investitionsbewertung, die alle Anschaffungs- und Betriebskosten über die gesamte Lebensdauer der Anlage berücksichtigt. Die Berechnung erfolgt wie folgt: TCO = Anschaffungspreis + Installationskosten + Werkzeuginvestition + Schulungskosten + (Jährliche Betriebskosten × Jahre) + (Jährliche Wartungskosten × Jahre) – Restwert. Typische Komponenten für ein 5-Achs-System der Mittelklasse sind: Anschaffungspreis $250.000, Installations- und Montagekosten $15.000–$25.000, Erstausstattung mit Werkzeugen $50.000–$100.000, Bedienerschulung $20.000–$40.000 und jährliche Betriebskosten $45.000–$65.000 (Stromverbrauch, Wartung und Werkzeugersatz).

Die Berechnung des jährlichen Nettogewinns quantifiziert die finanziellen Vorteile und ermöglicht die Bestimmung der Amortisationszeit anhand von vier primären Wertströmen. Die Umsatzsteigerung durch Kapazitätserweiterungen resultiert aus dem erweiterten Arbeitsumfang und der simultanen 5-Achs-Bearbeitung, wodurch die Zykluszeiten für komplexe Geometrien um 60–75 TP/3T reduziert werden. Dies führt zu einer Durchsatzsteigerung von 25–200 TP/3T, abhängig von der Teilekomplexität. Die Lohnkostenreduzierung von durchschnittlich 25 TP/3T ergibt sich aus der Verringerung der Rüstzeiten um 65–75 TP/3T, da durch die Bearbeitung in einer einzigen Aufspannung 2–4 Stunden Umpositionierungsarbeit pro Teil entfallen. Die Verbesserung der Ausschussquote von 81 TP/3T auf unter 11 TP/3T generiert erhebliche Einsparungen durch höhere Präzision und Genauigkeit in einer einzigen Aufspannung bei gleichzeitig engeren Toleranzen. Die Akquise neuer margenstarker Aufträge nutzt die 5-Achs-Fähigkeiten, die die Bearbeitung komplexer Konturen und die Erfüllung enger Toleranzanforderungen ermöglichen, welche zuvor die Auslagerung erforderten.

Die Formel zur Berechnung der Amortisationszeit liefert eine wichtige Entscheidungsgrundlage: Amortisationszeit = Gesamtinvestition ÷ Jährlicher Nettogewinn**. Ein repräsentatives Beispiel veranschaulicht die praktische Anwendung: Eine Gesamtinvestition von 250.000 (einschließlich 200.000 Ausrüstung, 20.000 Installation, 20.000 Werkzeug und 10.000 Schulung) geteilt durch einen jährlichen Nettogewinn von 100.000 (bestehend aus 60.000 Kapazitätserhöhung, 25.000 Arbeitskosteneinsparung und 15.000 Ausschussreduzierung) ergibt eine Amortisationszeit von 2,5 Jahren, die gemäß Branchenstandards als „gut“ eingestuft wird. Hersteller, die jährlich mehr als 10.000 Teile bearbeiten und durch die Reduzierung der Rüstzeiten messbare Arbeitskosteneinsparungen erzielen, erreichen typischerweise Amortisationszeiten von 2–3 Jahren.

Drei- und Fünfjahres-ROI-Prognosen zeigen eine Sensitivität gegenüber Produktionsvolumenschwankungen und Marktbedingungen. Eine konservative Dreijahresanalyse für eine Investition von 1.400.425.000 in ein 5-Achs-VMC, die durch reduziertes Outsourcing und schnellere Zykluszeiten jährliche Einsparungen von 1.400.178.000 generiert, ergibt einen ROI von 421.300 im ersten Jahr mit einer Amortisationszeit von 2,4 Jahren. Erweiterte Fünfjahresprognosen müssen das Risiko der Technologieveralterung, steigende Wartungskosten (typischerweise 15–201.300 nach Ablauf der Garantie) und den Wettbewerbsdruck, der Margenverbesserungen potenziell schmälert, berücksichtigen. Die Auslastung hat entscheidenden Einfluss auf die Kosten pro produktiver Stunde: Anlagen mit einer Auslastung von 851.300.0 ...

Herunterladbare Berechnungsvorlagen ermöglichen eine werksspezifische Modellierung unter Einbeziehung benutzerdefinierter Parameter, darunter bestehende Lohnsätze, aktuelle Ausschussquoten und anlagenspezifische Energiekosten. CNC-Gesamtbetriebskostenrechner Bietet regionale Steueroptimierung für Standorte in den USA, der EU und Asien mit Abschreibungstabellen und Kapitalwertanalyse. Hersteller sollten Sensitivitätsszenarien modellieren, die das Produktionsvolumen um ±301 TP3T und den Margendruck, der den Umsatz pro Teil um 10-151 TP3T reduziert, modellieren, um die Investitionsstabilität über Konjunkturzyklen hinweg zu testen.

Die Dimensionierung des Arbeitsbereichs erfordert eine präzise Abstimmung zwischen Verfahrwegen der Maschine und den Anforderungen des Produktionsportfolios, um Unterauslastung oder Spezifikationsdefizite zu vermeiden. Einstiegssysteme mit 400–610 mm Verfahrweg in X-Richtung eignen sich für kleine Präzisionsbauteile in der Medizintechnik und Werkzeugindustrie, während Systeme mit 600–800 mm Verfahrweg im mittleren Bereich Komponenten für Automobilgetriebe und Strukturbauteile der Luft- und Raumfahrt aufnehmen. Hersteller sollten die historischen Bauteilabmessungen im 80. Perzentil des Produktionsvolumens analysieren – Systeme, die für das 90. Perzentil ausgelegt sind, bergen das Risiko einer Unterauslastung, während eine Auslegung auf das 70. Perzentil die weitere Auslagerung größerer Bauteile erzwingt. Vertikale Bearbeitungszentren benötigen in der Regel weniger Stellfläche als horizontale, wobei die OPMT Light 5X-Systeme mit einer kompakten Grundfläche von 1700–2300 mm Länge ein Beispiel darstellen.

Spindelspezifikationen unterscheiden allgemeine Fertigungsanwendungen von Anforderungen an die Präzisionsbearbeitung durch Drehzahl- und Drehmomentcharakteristik. Standardspindeln mit 15.000–20.000 U/min bearbeiten Stahl, Aluminium und Verbundwerkstoffe in der Bauteilfertigung und erzielen für die meisten unkritischen Anwendungen eine ausreichende Oberflächengüte. Hochgeschwindigkeitskonfigurationen mit über 40.000 U/min ermöglichen die Präzisionsbearbeitung von Schneidwerkzeugen und die Oberflächenvorbereitung von medizinischen Implantaten mit Oberflächenrauheitsspezifikationen von Ra 0,2–0,4 μm. OPMT 563V zeigt fortschrittliche Leistungsfähigkeit mit einer Spindeldrehzahl von 20.000 U/min in Kombination mit einem Eilgang von 48 m/min, wodurch die Leerlaufzeit ohne Schneiden reduziert wird (32% im Vergleich zu Standardkonfigurationen).

Die Optimierung der Stellfläche durch vertikale Maschinenarchitekturen bietet einen deutlichen Mehrwert für kleine und mittlere Unternehmen mit begrenztem Platzangebot. Kompakte vertikale 5-Achs-Systeme benötigen eine Stellfläche von 6–10 m² (typischerweise 2300 x 1800 mm für OPMT Light 5X 60V) und sparen damit 401 TP3T Platz im Vergleich zu horizontalen Konfigurationen, die zusätzlichen Freiraum für Palettenwechsler und einen größeren Arbeitsbereich erfordern. Planer müssen jedoch die Zusatzausrüstung wie Werkzeugvoreinstellstationen (ZOLLER-Systeme), Späneabsaugung und Kühlmittelfiltersysteme berücksichtigen, die die Stellfläche der Maschine um 30–501 TP3T vergrößern. Die vertikale Ausrichtung vereinfacht die Späneabsaugung durch Schwerkraftunterstützung und ermöglicht gleichzeitig eine ergonomische Bedienung durch die 1,6 m über dem Boden positionierten Bedienelemente.

Die Wahl des Steuerungssystems zwischen NUM-, FANUC- und Siemens-Plattformen beeinflusst die Programmierzugänglichkeit für das bestehende Personal und die langfristigen Software-Upgrade-Pfade. Die in OPMT-Anlagen eingesetzten NUM-CNC-Systeme bieten eine offene Architektur, die Dreh-, Fräs-, Schleif- und Laseranwendungen durch eine modulare NCK-Struktur unterstützt. Diese ermöglicht bis zu 32 Achsen pro NCK und bietet RTCP-Kompatibilität (Rotated Tool Center Point), die für die 5-Achs-Programmierung unerlässlich ist. FANUCs dominante Marktposition mit 2,4 Millionen weltweit installierten CNC-Systemen und 12,7 Millionen Servomotoren bietet umfangreiche Programmierkenntnisse und die Integration von CAM-Software von Drittanbietern, allerdings zu höheren Preisen. Bei der Entscheidung sollte die Kompatibilität mit der bestehenden Ausrüstung im Vordergrund stehen, um die Vertrautheit der Bediener und die Wiederverwendung der Werkzeugwegbibliothek zu nutzen, anstatt die vermeintliche technologische Überlegenheit unbekannter Plattformen anzustreben.

Die Anforderungen an die unterstützende Infrastruktur werden häufig übersehen, was zu Installationsverzögerungen und Kostenüberschreitungen führt. Die Stromversorgung für 5-Achs-Systeme der Einstiegsklasse benötigt 23 kVA (380 V AC ±101 TP3T), während Geräte der Mittelklasse 25–35 kVA benötigen. Dies erfordert in älteren Anlagen eine Modernisierung der Stromversorgung. Die Druckluftversorgung mit 0,7 MPa und 500 l/min unterstützt pneumatische Spann- und Späneabsaugsysteme. Für Anlagen mit einem Gewicht von 3.500–4.500 kg sind Betonböden mit einer Druckfestigkeit von mindestens 4.000 PSI und Schwingungsdämpfung erforderlich, die für eine Positioniergenauigkeit von ±0,003–0,005 mm geeignet sind. Die gesamten Kosten für die Anlagenvorbereitung erhöhen das Projektbudget je nach Eignung der vorhandenen Infrastruktur um 10.000–25.000 TP4T.

Die Phase-1-Analyse der Produktionsstätte vor dem Kauf (Wochen 1–4) dient der Feststellung der technischen Machbarkeit und der Identifizierung von Infrastrukturlücken, die vor der Auslieferung der Ausrüstung behoben werden müssen. Die Analyse umfasst Berechnungen der Bodenbelastung, die die Tragfähigkeit der Konstruktion für eine Maschinenmasse von 3.500–6.000 kg zuzüglich der dynamischen Belastung durch die Beschleunigung der Eilgangachsen überprüfen. Die Bewertung der Stromversorgung ermittelt die verfügbare Kapazität im Hinblick auf den Bedarf von 23–35 kVA, wobei in Gebieten mit begrenzter Kapazität mit möglichen Vorlaufzeiten von 6–12 Wochen für die Aufrüstung der Stromversorgung durch die Energieversorger zu rechnen ist. Die Workflow-Analyse bildet die aktuelle Produktionsroute ab, identifiziert Engpässe, bei denen die Zykluszeiten durch die 5-Achs-Bearbeitung am deutlichsten verkürzt werden, und quantifiziert die Kapazitätsgewinne zur Begründung des ROI.

Die Installation und Schulung in Phase 2 (Wochen 5–8) umfasst die Geräteanlieferung, die präzise Nivellierung, die Kalibrierungsprüfung und die Weiterbildung der Bediener. Professionelle Montagedienste positionieren die Geräte mithilfe von Laserausrichtungssystemen auf ±0,1 mm genau. Anschließend erfolgt eine 7- bis 14-tägige Einschwingphase vor der finalen Kalibrierung. Die Kalibrierungsprotokolle beinhalten Kugelstabtests, Laserinterferometrie und die Überprüfung der Linienparallelität, um eine Positioniergenauigkeit von ±0,003–0,005 mm im gesamten Arbeitsbereich zu gewährleisten. Die Bedienerschulungen umfassen eine einwöchige Präsenzschulung zu Inspektionsverfahren, grundlegender Programmierung, Werkzeugeinrichtung und Wartungsprotokollen. Umfassende Schulungsunterlagen unterstützen die kontinuierliche Weiterentwicklung der Fähigkeiten. Für die fortgeschrittene CAM-Softwareschulung sind zusätzliche 3–5 Tage erforderlich, die sich auf die 5-Achs-Werkzeugweggenerierung, Kollisionserkennung und RTCP-Programmiertechniken konzentrieren.

Die Produktionshochlaufphase 3 nutzt die Effizienzgewinne von 65–751 TP3T durch die Umstellung der Bediener von 3-Achs-Mehraufspannungsprozessen auf integrierte 5-Achs-Programme. Die ersten Produktionsläufe konzentrieren sich bewusst auf Teile mittlerer Komplexität, um den Kompetenzaufbau zu fördern, ohne die Fertigung hochwertiger Komponenten während der 4–8-wöchigen Lernphase zu gefährden. Hersteller, die strukturierte Hochlaufprotokolle implementieren, berichten von einer Auslastung der Nachtschichtkapazität von 951 TP3T innerhalb von 3 Monaten, da der mannlose Betrieb mit zuverlässigen Vorrichtungen und bewährten Programmen möglich wird. Die Einzelteilbearbeitungszyklen zeigen eine Zeitersparnis von 60–751 TP3T für Teile mittlerer Komplexität. Bei einer repräsentativen Anwendung für einen Titan-Wirbelsäulenstab konnte die Zykluszeit von 5,8 Stunden auf 4,2 Stunden reduziert werden, was zu Energieeinsparungen von 18,50 € pro Teil führte.

Die Personalentwicklung durch KI-optimierte CAM-Software wie GTR reduziert die Programmierkomplexität von über 12 Stunden pro Teil auf 2 Stunden Rüstzeit – eine um 80% schnellere Iteration. Die Software nutzt parametrische Programmierung für Dreh- und Festwerkzeuganwendungen und generiert automatisch 3D-Werkzeugwege aus importierten DXF-Geometriedateien bei gleichzeitiger direkter Maschinensimulation. Bediener von Funkenerosionsmaschinen können mit minimalem Schulungsaufwand auf die Laserbearbeitung umsteigen, da branchenübliche Programmierlösungen den Import bestehender Projekte ermöglichen. Hersteller sollten in den ersten 6 Monaten 160–240 Stunden Bedienerschulung einplanen, davon 60% für die praktische Maschinenbedienung, 25% für die CAM-Programmierung und 15% für Wartungsarbeiten.

Die Instandhaltungsplanung etabliert vorausschauende Systeme, die durch planmäßige Inspektionsintervalle und Zustandsüberwachung eine Verfügbarkeit von 981 TP3T gegenüber 851 TP3T bei reaktiven Instandhaltungsansätzen erreichen. Linearmotoren und Rollenführungen in OPMT-Systemen erfordern vierteljährliche Schmierung und jährliche Überprüfung der Kugelstangengenauigkeit, um eine Wiederholgenauigkeit von ±0,003 mm über längere Betriebszeiten zu gewährleisten. Umfassende Serviceverträge mit jährlichen Kosten von 10–151 TP3T der Anlagenkosten beinhalten garantierte Reaktionszeiten (24 Stunden innerhalb der Provinz, 48 Stunden außerhalb der Provinz gemäß OPMT-Standards), planmäßige vorbeugende Wartung und prioritäre Ersatzteilverfügbarkeit. Dadurch werden Ausfallzeiten um 15–20 Stunden jährlich reduziert, was Opportunitätskosten von 1 TP4T45.000–1 TP4T60.000 für Anlagen mit einem Stundenumsatz von über 1 TP4T3.000 entspricht.

Die Reduzierung der Rüstzeiten ist der am besten quantifizierbare ROI-Faktor. Durchschnittliche Einsparungen von 65–751 TP³T entsprechen direkten Lohnkosteneinsparungen von 251 TP³T in typischen KMU-Produktionsumgebungen. Traditionelle 3-Achs-Workflows, die 2–4 Stunden Rüstzeit pro Teil erfordern, werden durch 5-Achs-Ein-Rüst-Operationen mit einer Rüstzeit von 30–45 Minuten ersetzt. Dadurch werden ca. 751 TP³T an direkten Lohnkosten für die Maschineneinrichtung eingespart. Für Hersteller, die jährlich mehr als 10.000 Einheiten zu einem Stundensatz von 1 TP4T45 verarbeiten, generiert die Reduzierung der Rüstzeiten allein jährliche Einsparungen von 1 TP4T90.000–1 TP4T120.000. Die Lohnkosteneinsparungen verstärken sich durch den Wegfall von Vorrichtungskosten – ein Zulieferer für medizinische Komponenten reduzierte die jährlichen Ausgaben für Vorrichtungen von 1 TP4T85.000 auf 1 TP4T12.000 durch bildbasierte Teileerkennung. Dadurch entfielen kundenspezifische Vorrichtungen, und die Rüstzeit wurde von 25 auf 4 Minuten verkürzt.

Qualitätsverbesserungen zeigen sich in der Reduzierung der Ausschussrate von üblicherweise 6–81 TP3T auf unter 11 TP3T. Die hohe Präzision der 5-Achs-Bearbeitung in einer Aufspannung eliminiert die kumulative Toleranzanhäufung durch mehrfache Nachbearbeitung. Bei einem Produktionsvolumen von 1 TP4T5 Millionen Stück jährlich führt die Reduzierung des Ausschusses von 71 TP3T auf 11 TP3T zu einer Einsparung von 1 TP4T300.000 an Material- und Arbeitskosten. Verbesserungen der Oberflächengüte von Ra 1,6–3,2 μm (3-Achs) auf Ra 0,4–0,8 μm (5-Achs) reduzieren oder eliminieren Nachbearbeitungsschritte. Bei Anwendungen für medizinische Implantate wird Ra 0,2 μm direkt durch die 5-Achs-Bearbeitung erreicht. Die verbesserte Maßgenauigkeit ermöglicht eine präzisere Prozesssteuerung – ein Hersteller von PKD-Werkzeugen verbesserte die Markierungspositionierung von ±45 μm manueller Spannvorrichtung auf ±8 μm CNC-gesteuerte Positionierung, wodurch Nacharbeit und Qualitätsprüfungen entfallen.

Die Wirtschaftlichkeit einer Kapazitätserweiterung ist bei Produktionsvolumina über 10.000 Einheiten pro Jahr gegeben, wenn die Teilekomplexität Rüstzeitaufschläge rechtfertigt. Hersteller, die jährlich 10.800 Automobilzahnräder bearbeiten, steigerten ihre Produktion auf 14.400 Einheiten durch unterbrechungsfreies Eilgangfahren mit 48 m/min und eine Reduzierung der Leerlaufzeiten um 321 TP3T. Dadurch erzielten sie zusätzliche Einnahmen in Höhe von 1 TP4T280.000, ohne über die anfängliche Investition in eine 5-Achs-Maschine hinaus weitere Investitionen tätigen zu müssen. Die Gewinnschwelle für KMU liegt typischerweise im zweiten bis dritten Jahr, wenn sich die Lernkurve stabilisiert und die Entwicklung der Programmbibliothek einen schnellen Wechsel zwischen verschiedenen Auftragsarten ermöglicht. Die OPMT Light 5X-Systeme, die PKD-Schneidwerkzeuge bearbeiten, erreichen Zykluszeiten von 51 Minuten bei einer Genauigkeit von 0,005 mm und ermöglichen so eine Produktionskapazität von 1.000 Sätzen pro Jahr. Dies trägt dazu bei, dass sich die Amortisationszeit für KMU innerhalb der üblichen zwei bis drei Jahre beträgt.

Die Finanzierungsoptionen Leasing und Direktkauf bieten unterschiedliche steuerliche Vorteile, die je nach Rechtsordnung und Steuerposition des Unternehmens variieren. Operating-Leasing schont das Kapital für den Umlaufbestand und ermöglicht die Modernisierung der Technologie in Zyklen von 3 bis 5 Jahren, wodurch die Anlagenkapazitäten an die Marktanforderungen angepasst werden. Die Gesamtkosten über die Nutzungsdauer übersteigen jedoch in der Regel den Direktkauf um 15 bis 251 Billionen PKR. Direktkäufe ermöglichen beschleunigte Abschreibungspläne (MACRS 5 Jahre für US-Hersteller), die im ersten Jahr Steuervorteile von 20 bis 401 Billionen PKR der Anlagenkosten generieren, abhängig von der Verfügbarkeit von Bonusabschreibungen. KMU mit begrenzten liquiden Mitteln sollten Anlagenfinanzierungsverträge mit den aktuellen Zinssätzen von 6 bis 81 Billionen PKR gegen die Opportunitätskosten des anderweitig im Betrieb eingesetzten Kapitals abwägen. Der Break-even-Punkt ist erreicht, wenn die Renditen alternativer Investitionen die Finanzierungskosten zuzüglich der entgangenen Vorteile durch die zeitliche Abschreibung übersteigen.

Zu den Risikofaktoren, die Minderungsstrategien erfordern, zählen Marktschwankungen, Technologieveralterung und Fachkräftemangel. Das Risikomanagement bei Nachfrageschwankungen priorisiert die Anlagenauswahl mit Fokus auf Flexibilität für verschiedene Teilefamilien anstatt auf spezialisierte Einzelanwendungen. Vertikale Bearbeitungszentren bieten im Vergleich zu horizontalen Konfigurationen eine höhere Flexibilität in der Fertigung. Der Schutz vor Technologieveralterung konzentriert sich auf Steuerungssysteme, die Software-Upgrades und die Integration von CAM-Systemen mit offener Architektur unterstützen. Die Plattformen von NUM und FANUC weisen Supportzyklen von 10 bis 15 Jahren auf, wobei die Abwärtskompatibilität die Programmbibliotheken schützt. Der Fachkräftemangel wird durch schlüsselfertige Schulungsprogramme und intuitive Benutzeroberflächen abgemildert. OPMT bietet einwöchige Schulungen vor Ort sowie eine umfassende Dokumentation, die die Programmiergeschwindigkeit von 80% durch standardisierte Arbeitsabläufe verbessert.

Kleine und mittlere Unternehmen, die 2026 Investitionen in 5-Achs-CNC-Maschinen evaluieren, profitieren von der Marktreife, die Präzision auf Unternehmensniveau zu KMU-gerechten Preisen im Bereich von $125.000 bis $500.000 bietet. Das vertikale Laserbearbeitungssystem OPMT Light 5X 40V ist ein Beispiel für diese Zugänglichkeit und bietet eine Positioniergenauigkeit von 0,005 mm sowie NUM-CNC-Steuerung zu wettbewerbsfähigen Preisen für Hersteller von Schneidwerkzeugen und Präzisionsbauteilen. Die Haas UMC-500 setzt den bewährten Einstiegsstandard für die allgemeine Fertigung, während die Systeme von DMG MORI, Mazak und Okuma im mittleren Preissegment Leistungsfähigkeit auf Luft- und Raumfahrtniveau für wachsende Betriebe bieten.

Die finanzielle Rechtfertigung basiert auf quantifizierbaren ROI-Komponenten: Reduzierung der Rüstzeiten um 65–751 TP³T, was zu einer Arbeitsersparnis von 251 TP³T führt, Senkung der Ausschussquote von 81 TP³T auf unter 11 TP³T und Kapazitätserweiterung, die einen Durchsatzzuwachs von 25–2001 TP³T bei komplexen Geometrien ermöglicht. Hersteller mit einer Jahresproduktion von über 10.000 Einheiten erreichen typischerweise Amortisationszeiten von 2–3 Jahren, wenn die Implementierung in strukturierten Phasen erfolgt, die eine Bedarfsanalyse vor dem Kauf, eine professionelle Installation mit umfassender Schulung und einen systematischen Produktionshochlauf mithilfe KI-optimierter CAM-Programmierung umfassen.

Die Auswahlkriterien müssen die Dimensionierung des Arbeitsbereichs mit den Portfolioanforderungen, die Spindelspezifikationen entsprechend den Material- und Oberflächenanforderungen sowie die Optimierung der Stellfläche durch vertikale Konfigurationen, die den Platzbedarf der 40% reduzieren, in Einklang bringen. Eine sorgfältige Planung der kritischen Infrastruktur für eine elektrische Versorgung von 23–35 kVA, Druckluft von 0,7 MPa und die Vorbereitung der Anlage verhindern Installationsverzögerungen und Kostenüberschreitungen. Risikominderungsstrategien, die auf Flexibilität der Anlagen, Langlebigkeit der Steuerungssysteme und eine strukturierte Personalentwicklung setzen, positionieren KMU-Hersteller für nachhaltige Wettbewerbsvorteile durch fortschrittliche 5-Achs-Bearbeitungskapazitäten ab 2026.

Für detaillierte technische Spezifikationen und Vorführungsmöglichkeiten kontaktieren Sie uns bitte. Die spezialisierten 5-Achsen-Lösungen von OPMT Laser Team oder erkunden Sie unsere umfassender Lieferantenvergleichsleitfaden.

Kleinere Betriebe mit einer Jahresproduktion von über 10.000 Teilen erreichen typischerweise Amortisationszeiten von 2–3 Jahren für Investitionen in 5-Achs-CNC-Maschinen (125.000–250.000 £). Die Amortisationsberechnung ergibt sich aus der Division der Gesamtinvestition (Maschine, Installation, Werkzeuge und Schulung) durch den jährlichen Nettogewinn aus reduzierten Rüstzeiten, geringeren Arbeitskosten und weniger Ausschuss. Hersteller, die 5-Achs-Technologie einsetzen, berichten von einer Reduzierung der Rüstzeiten um 65–75 £, was zu Einsparungen von 25 £ bei den Arbeitskosten führt. Gleichzeitig sinkt die Ausschussquote dank der hohen Präzision in einer einzigen Aufspannung von 8 £ auf unter 1 £. Amortisationszeiten unter 2 Jahren gelten als „exzellent“ und werden typischerweise bei der Übernahme margenstarker, zuvor ausgelagerter Aufträge erzielt. Amortisationszeiten von 3–5 Jahren sind für strategische Kapazitätserweiterungen weiterhin „akzeptabel“.

Die Haas UMC-500 und die OPMT Light 5X 40V bieten ein optimales Preis-Leistungs-Verhältnis im Einstiegssegment $125.000–$200.000 für kleine und mittlere Unternehmen. Die Haas UMC-500 überzeugt mit bewährter Zuverlässigkeit zum Basispreis von $125.000–$150.000 und bietet einen Arbeitsbereich von 610 x 406 x 406 mm sowie eine Spindeldrehzahl von 8.100 U/min, die für allgemeine Fertigungsanwendungen geeignet ist. Die OPMT Light 5X 40V bietet spezialisierte vertikale Laserbearbeitungsfunktionen mit einer Positioniergenauigkeit von 0,005 mm, NUM-CNC-Steuerung und einem Verfahrweg von 400 x 250 x 300 mm, optimiert für die Fertigung von Schneidwerkzeugen und Präzisionsbauteilen. Beide Systeme beinhalten Installationsunterstützung und Bedienerschulung. Die jährlichen Betriebskosten liegen bei vergleichbaren $40.000–$60.000 und umfassen Werkzeuge, Wartung und Stromverbrauch. Die Wahl zwischen diesen Plattformen hängt vom Anwendungsschwerpunkt ab – Haas für vielseitige Lohnfertigungsarbeiten versus OPMT für die spezialisierte Bearbeitung superharter Materialien, die eine Laserintegration erfordert.

Vertikale 5-Achs-Systeme benötigen eine Stellfläche von 6–10 m² mit typischen Abmessungen von 1700–2300 mm Länge × 1800–1900 mm Breite. Dies entspricht einer Platzersparnis von 401 TP3T im Vergleich zu horizontalen Konfigurationen. Die OPMT Light 5X 40V benötigt eine Stellfläche von 1700 × 1900 mm bei einer Höhe von 2600 mm, während die größere Light 5X 60V eine Stellfläche von 2300 × 1800 mm benötigt und einen Verfahrweg der X-Achse von 600 mm ermöglicht. Planer müssen zusätzlichen Platz für Werkzeugwechsel, Bedienerzugang und Zusatzausrüstung wie Späneabsaugung und Kühlsysteme einplanen. Dies erhöht die Stellfläche der Maschine in der Regel um 30–501 TP3T. Hersteller sollten pro Maschine eine Gesamtfläche von mindestens 12–15 m² einplanen, einschließlich Wartungszugängen, und sicherstellen, dass die Deckenhöhe eine Gerätehöhe von 2600–2800 mm sowie die Durchfahrtshöhe für einen Kran zur Installation und Wartung ermöglicht.

Die jährlichen Betriebskosten für 5-Achs-CNC-Systeme in mittelgroßen Produktionsumgebungen belaufen sich je nach Anlagenklasse, Auslastungsgrad und Werkzeugbedarf auf insgesamt 40.000 bis 85.000 Tsd. ... Die mittleren Marktsegmente von Mazak und DMG MORI verursachen jährliche Kosten zwischen 45.000 und 75.000 TP4T, während Premium-Systeme von Okuma Kosten zwischen 55.000 und 85.000 TP4T erreichen. Dies spiegelt den höheren Wartungsaufwand und die Anforderungen an Spezialwerkzeuge wider. Hersteller, die eine Auslastung von 851 TP3T erzielen, optimieren die Kosten pro produktiver Stunde auf 14,71 TP4T gegenüber 27,78 TP4T bei einer Auslastung von 451 TP3T. Dies unterstreicht die Bedeutung einer sorgfältigen Kapazitätsplanung.

Die vollständige Implementierung einer 5-Achs-CNC-Maschine von der Bestellung bis zur vollen Produktionskapazität dauert 8–16 Wochen und erfolgt in drei Phasen. Phase 1, die Vorbewertung der Produktionsstätte, nimmt die ersten vier Wochen in Anspruch und umfasst die Bewertung der Infrastruktur, die Überprüfung der Stromversorgung und die Workflow-Analyse zur Ermittlung der Rentabilität. Phase 2, Installation und Schulung (Wochen 5–8), beinhaltet die Lieferung der Maschinen, die präzise Nivellierung, die Kalibrierungsprüfung zur Erreichung einer Positioniergenauigkeit von ±0,003–0,005 mm sowie eine einwöchige Bedienerschulung vor Ort, die Programmierung, Einrichtung und Wartung umfasst. Phase 3, der Produktionshochlauf, benötigt weitere 4–8 Wochen, bis die Bediener mit den Arbeitsabläufen für Einzelaufspannungen und der CAM-Programmierung vertraut sind. Hersteller berichten von einer Kapazitätsauslastung der 95% innerhalb von 3 Monaten nach der Installation. Kundenspezifische Projekte mit speziellen Vorrichtungen oder Automatisierungsintegration können die Projektdauer auf maximal 16 Wochen verlängern, während Standardkonfigurationen von Anbietern wie OPMT mit schlüsselfertiger Software und vorkonfigurierten Steuerungssystemen eine beschleunigte Implementierung in 8–10 Wochen ermöglichen.

Haftungsausschluss

Dieser Inhalt wurde von OPMT Laser auf Grundlage öffentlich verfügbarer Informationen zusammengestellt und dient ausschließlich zu Referenzzwecken. Die Erwähnung von Marken und Produkten Dritter dient dem objektiven Vergleich und stellt keine kommerzielle Verbindung oder Billigung dar.

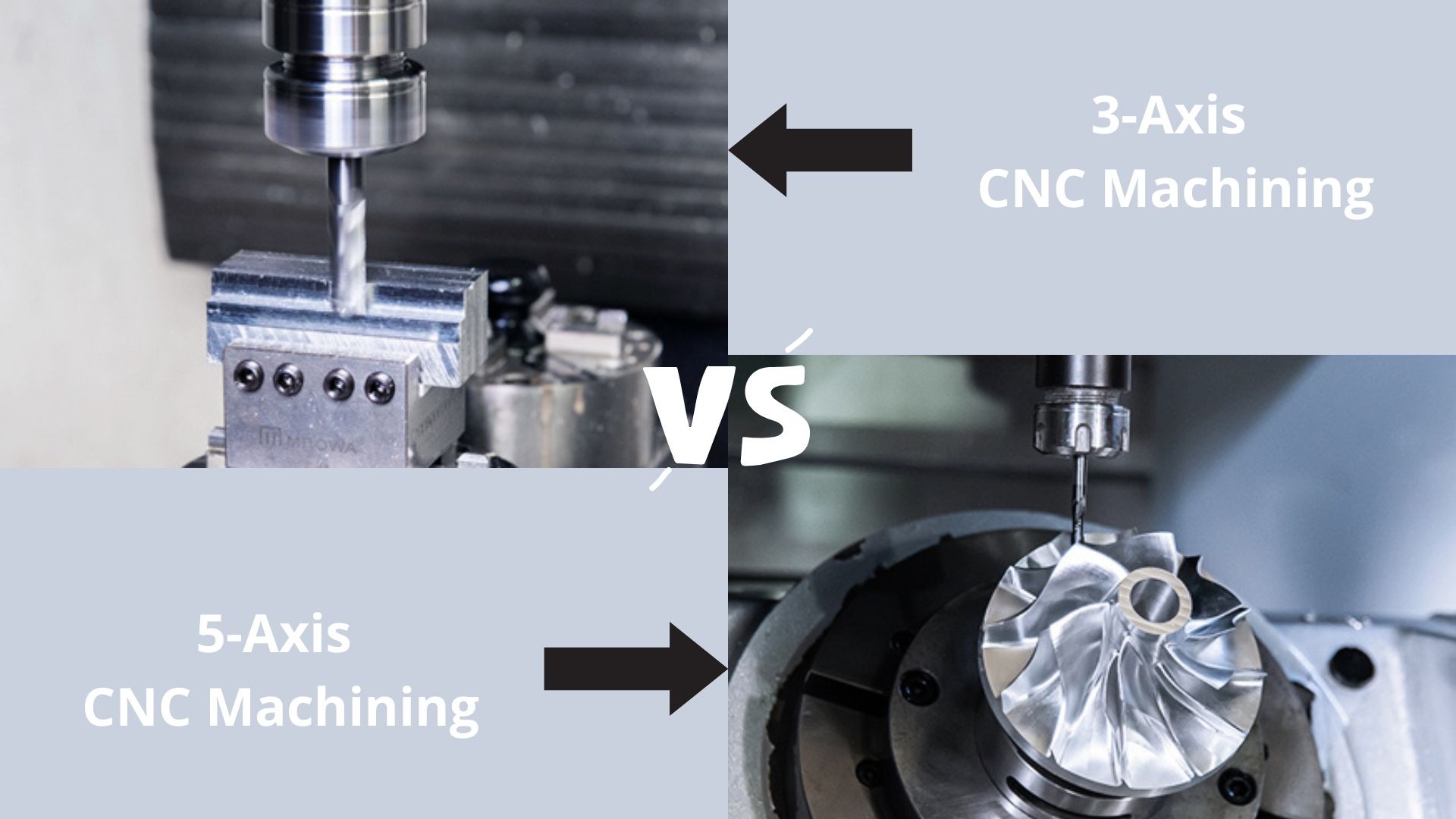

Entdecken Sie die Welt der CNC-Bearbeitung, indem wir 3-Achsen- und 5-Achsen-Technologien vergleichen. Von einfachen Vorgängen bis hin zu komplexen Geometrien – finden Sie heraus, welche Maschine Ihren Fertigungsanforderungen im Jahr 2025 entspricht.

Entdecken Sie OPMTs bewährten 5-Phasen-ODM-Prozess für kundenspezifische Lasersysteme. ISO-zertifizierte Fertigung, Präzision ±0,003 mm, IP-Schutz. Senden Sie uns noch heute Ihre Projektanforderungen.

Suchen Sie nach den besten Anbietern für 5-Achsen-CNC-Bearbeitungszentren? In unserer Top-10-Liste finden Sie Expertenwissen und die perfekte Lösung für Ihre Anforderungen!

Entdecken Sie die 10 besten Laser-Metallschneidmaschinen des Jahres 2025, darunter Branchenführer wie Trumpf, Bystronic und OPMT Laser. Vergleichen Sie Spitzentechnologie, Präzision und Effizienz, um die perfekte Lösung für Ihre Fertigungsanforderungen zu finden.

Bitte geben Sie Ihre Kontaktinformationen ein, um das PDF herunterzuladen.