Schedule a Visit

Regardless of whether you require general advice or specific support, we are happy to help you.

Regardless of whether you require general advice or specific support, we are happy to help you.

All News

Share

Choosing a sheet metal laser cutting machine factory matters more than most procurement teams realize. You’re not buying a machine—you’re entering a 10-15 year relationship that determines uptime, support quality, and whether you can actually get parts when something breaks at 2 AM on a Saturday.

I’ve audited 30+ laser equipment factories across China, Germany, and the United States. The gap between best and worst is stunning. Two factories might have identical ISO certificates and similar specifications, but one ships machines that hold ±0.003mm accuracy after three years while the other can’t maintain ±0.05mm after six months. The difference shows up in how they build equipment, not what they claim on datasheets.

Factory infrastructure tells you whether a manufacturer actually builds machines or just assembles components from suppliers. This distinction affects everything from positioning accuracy to whether you can get support when problems occur.

Walk into an assembly-only facility and you’ll see workers bolting together components from boxes. These operations have minimal machining equipment—maybe a drill press and some hand tools. They’re basically IKEA furniture assembly at industrial scale.

Real manufacturers machine their own critical components. OPMT’s 30,000m² facility runs CNC machining centers producing gantry rails, beam delivery assemblies, and precision mounting systems. Why does this matter? Tolerances stack. When you buy a gantry from one supplier, linear guides from another, and servo mounts from a third, you’re hoping three companies’ tolerance specifications align. They usually don’t.

I’ve measured positioning errors on machines from assembly operations. Claims of ±0.03mm accuracy. Actual performance: ±0.08mm at room temperature, ±0.15mm after the machine heats up. The gantry rails weren’t straight, the linear guides weren’t parallel, and nobody verified the assembly geometry.

IPG Photonics manufactures fiber laser sources in-house. Most competitors buy from IPG or Coherent. When your laser fails, IPG customers call the source manufacturer directly. OEM customers call their machine manufacturer, who calls IPG, who schedules a service call. That’s an extra week of downtime.

Here’s what matters: steel expands 11.7 micrometers per meter per degree Celsius. Your machine has a 3-meter gantry. A 1°C temperature swing moves the cutting head 35 microns—bigger than the ±0.03mm accuracy spec.

Professional facilities maintain 20°C ±0.5°C in assembly areas. I’ve verified this by leaving temperature loggers overnight. Budget operations work at ambient temperature. Summer afternoons might hit 32°C while winter mornings drop to 15°C. Machines assembled under these conditions cannot hold tight tolerances.

OPMT’s assembly area uses precision HVAC. Cheaper facilities have standard air conditioning that cycles on and off, creating 2-3°C temperature swings. You can spot this during factory visits—ask to see temperature monitoring records. Professional operations log temperature continuously. Budget shops can’t produce the data because they don’t collect it.

Good factories move materials in one direction: raw materials → machining → assembly → testing → packaging. Poor layouts scatter operations across multiple buildings. I’ve seen facilities where partially assembled machines sit outside between buildings. Thermal cycling, contamination from dust, potential for handling damage.

Batch manufacturing builds machines in groups. The factory completes 20 units of Model A, then switches tooling for 15 units of Model B. This requires lower capital investment but kills lead times. Order during the wrong batch cycle and you wait 6-8 weeks for production to loop back to your model.

Flexible manufacturing systems (FMS) switch between configurations quickly. Trumpf’s factories can build different laser power levels on the same line. Tooling changeover takes hours, not weeks. Most manufacturers run batch production because FMS requires sophisticated production control systems.

A 6kW fiber laser system draws 18kW from the wall—laser source (8-9kW), chiller (5-6kW), motion control (2-3kW), auxiliaries (2-3kW). Facilities without adequate electrical infrastructure experience voltage sag during peak demand. This destabilizes laser output and accelerates component wear.

Professional facilities have backup generators that activate within 10 seconds. This protects work in progress and prevents thermal shock to sensitive optical components. I’ve never seen backup power at budget manufacturers. Power interruption? Machine crashes mid-cut, thermal shock potentially damages laser optics, and you restart from the beginning.

Production numbers tell you about lead times, negotiating leverage, and whether your supplier can support growth. But manufacturers game these statistics, so you need to understand what the numbers actually mean.

Han’s Laser claims 200+ units annually. KRRASS advertises 600 units per year across multiple product lines. OPMT produces 130 units annually, but these are specialized 5-axis systems requiring longer assembly times.

These numbers hide important details. “Annual capacity” might mean theoretical maximum with perfect conditions, all stations running, no quality issues, full component availability. Actual production runs at 65-80% of theoretical capacity at well-managed operations.

Ask about current capacity utilization. A manufacturer at 90% capacity cannot expedite your order without delaying someone else’s. One at 60% utilization has room to maneuver. Most manufacturers won’t disclose this, but you can infer it from lead times. Standard 90-day lead time probably means high utilization. Offering 45-60 days suggests available capacity.

Standard lead times run 45-90 days. Let’s break down where this time goes:

Manufacturers advertising 30-day delivery either maintain inventory of finished machines (expensive, risky if specifications change) or have pre-purchased components (works only for standard configurations). Custom specifications cannot ship in 30 days unless the manufacturer had already started building on speculation.

Bystronic maintains buffer inventory of common configurations. This reduces lead times but increases their working capital costs. They’re betting on demand forecasts. When they guess wrong, they have unsold inventory sitting in warehouses.

Production lines scale in different ways. Fixed assembly stations have capacity limited by floor space and station count. Adding capacity means building new facilities or running additional shifts.

Modular production with standardized workstations scales more easily. The manufacturer extends the line by adding stations or shifts. OPMT’s production uses documented procedures and standardized tooling that allows capacity expansion without redesigning the entire production process.

Component inventory strategy reveals supply chain sophistication. Professional manufacturers stock 30-60 days of long-lead-time parts (laser sources, CNC controllers, precision ball screws). Budget operations order components after receiving customer orders. This saves working capital but extends lead times and creates vulnerability to supply disruptions.

Bystronic operates factories in Switzerland, Germany, China, and the United States. Multi-site manufacturing reduces shipping costs and provides some redundancy. But quality consistency across facilities is challenging. I’ve seen the same model from different Bystronic facilities with measurably different performance characteristics.

Single-facility manufacturers have lower overhead but higher concentration risk. Political tensions, natural disasters, or local labor disputes shut down all production. You balance cost efficiency against supply chain resilience based on your risk tolerance.

Two factories with identical ISO 9001 certificates can deliver wildly different quality. Certificates prove you passed an audit. They don’t prove you use the quality system for actual decision-making.

ISO 9001 requires documented procedures, internal audits, and corrective action processes. Basic implementation creates minimal documentation, conducts cursory audits, and files everything in binders nobody reads.

Professional implementation integrates quality management into daily operations. During factory audits, I ask to see quality records from last week, not procedure manuals. Check calibration certificates for measurement equipment—expired calibrations mean the quality system exists on paper but not in practice.

OPMT’s system tracks every component from receiving inspection through final testing. Each machine has a complete build record with test data, calibration certificates, and operator signatures. This exceeds ISO 9001 requirements, but it provides traceability when problems occur. You can trace issues back to specific components, suppliers, or assembly steps.

CE marking is mandatory for European sales. It requires compliance with machinery safety, electromagnetic compatibility, and low voltage directives. Some manufacturers obtain CE certificates without actual testing—they hire consultants who prepare documentation based on component specifications rather than testing complete systems.

Request copies of test reports, not just certificates. Real CE compliance includes EMC testing in accredited labs, safety assessment by notified bodies, and technical documentation reviewed by engineers. Budget manufacturers use self-certification or cheap consultants producing paperwork that wouldn’t survive scrutiny.

Medical device manufacturers need suppliers with validation documentation. Laser systems processing medical components require IQ/OQ/PQ protocols (Installation Qualification, Operational Qualification, Performance Qualification). Most laser equipment manufacturers have no experience with this. You’ll need to develop validation documentation yourself unless the supplier already serves medical markets.

ISO 14001 environmental certification indicates systematic environmental management. Implementation quality varies as much as ISO 9001. Some manufacturers get certified to check a box for RFPs. Others actually track energy consumption, set reduction targets, and invest in efficiency improvements.

Laser interferometry testing measures actual positioning accuracy under operating conditions. A Renishaw laser interferometer costs $50,000+ and requires trained technicians. Factories using interferometry during assembly catch positioning errors before shipping.

Budget manufacturers use dial indicators and CMMs (coordinate measuring machines) for spot checks. This catches gross errors but misses systematic positioning drift, thermal expansion effects, and dynamic accuracy under acceleration. Customers discover these problems during acceptance testing.

High-speed cameras visualize cutting dynamics at 1000+ frames per second. This helps optimize parameters and diagnose edge quality issues. Only manufacturers serious about process understanding invest in this equipment. Most operate on trial-and-error parameter development.

Comprehensive positioning accuracy testing takes 4-8 hours per machine. You measure accuracy at dozens of positions across the work envelope, under different loading conditions, at operating temperature. This reveals positioning variations that spot checks miss.

Budget manufacturers test three corner positions in 30 minutes. Marketing materials claim ±0.03mm accuracy. Actual performance: ±0.03mm at the test positions, ±0.08mm in areas they didn’t measure. Customers discover this after installation.

Beam quality testing measures M² (beam quality factor), focal spot size, and power distribution. These parameters affect cutting performance more than raw laser power. A 6kW laser with M² of 1.2 cuts thinner materials better than 8kW with M² of 1.8. Most manufacturers don’t perform this testing—they assume specifications from the laser source supplier apply to the complete beam delivery system. Optical contamination, alignment errors, and thermal effects degrade beam quality between the laser source and workpiece.

R&D investment determines whether a manufacturer can support custom applications, adapt to new requirements, and provide actual technical expertise when you encounter problems.

Trumpf allocates approximately 9% of revenue to R&D. This funds laser source development, beam delivery optimization, and process control algorithms. Industry average sits at 3-5%. Manufacturers below 3% mostly copy competitors rather than innovating.

OPMT spends 12% of revenue on R&D, supporting a 54% R&D workforce ratio—engineers and scientists, not just assembly workers. This reflects the complexity of 5-axis ultrafast laser systems. Standard 2D sheet metal cutting needs less ongoing development once you’ve copied successful designs.

Low R&D investment shows up when you have problems. Call technical support with an unusual cutting application and budget manufacturers read from parameter charts. Their engineers haven’t developed deep process understanding because they don’t invest in application research.

Han’s Laser holds 5,000+ patents covering laser sources, optical systems, and process applications. OPMT has 300+ patents in multi-axis processing and precision positioning. Patent counts correlate loosely with innovation capability, though patent quality varies.

Look at patents relevant to your application. A manufacturer with 1,000 patents in 2D fiber cutting but none in multi-axis work lacks relevant expertise for complex applications. Patent filing velocity indicates ongoing innovation—50 patents from 2010-2015 and none since 2016 suggests reduced innovation activity.

Small manufacturers often lack specialized expertise. They have mechanical engineers who design frames and a software person who configures the CNC controller. Nobody specializes in thermal management, beam delivery optimization, or process development.

OPMT’s team includes optical engineers, laser physicists, kinematics specialists, and materials scientists. This depth supports applications in aerospace and medical devices where standard approaches fail. When you call with a problem cutting titanium at 15mm thickness, their engineers have actually studied titanium absorption characteristics and thermal effects.

Some manufacturers offer programs where you bring parts and engineers optimize cutting parameters. Trumpf and OPMT both provide this. Access to technical expertise often matters more than base specifications. A 6kW laser with optimized parameters frequently outperforms a 10kW laser with generic settings.

Budget manufacturers don’t offer this because they lack the technical depth. Their knowledge extends to what parameters work for their test parts. Your materials and geometries? You’ll figure it out yourself.

Supply chain architecture affects reliability, repair times, and your manufacturer’s ability to provide long-term support. Component sourcing strategies vary dramatically between manufacturers.

IPG Photonics manufactures fiber laser sources in-house, controlling laser reliability and performance optimization. When sources fail, IPG provides direct factory support with 2-3 day turnaround.

OEM assemblers buying from IPG or Coherent depend on supplier service schedules. Laser failure means the machine manufacturer contacts the supplier, coordinates service, and relays information. This adds 5-10 days versus direct relationships. Some OEM assemblers restrict access to laser suppliers, making you go through them for even basic troubleshooting.

OPMT uses NUM CNC controls with custom motion control software. The partnership allows acceleration profile optimization and trajectory planning for 5-axis simultaneous motion. Manufacturers using commodity CNC systems have less flexibility to optimize control algorithms.

Vertical integration costs money. IPG invested hundreds of millions developing fiber laser manufacturing capability. Most manufacturers cannot justify this investment, so they buy from component specialists. There’s no inherently correct answer—vertical integration provides control, OEM assembly provides flexibility and lower capital requirements.

Fiber laser sources come from IPG Photonics, Coherent, Raycus, or MAX. IPG dominates high-power applications above 10kW with proven reliability. Raycus and MAX offer lower-cost alternatives for standard cutting but with less field reliability data.

I’ve tracked failure rates. IPG sources in properly designed systems show <5% failure rate over five years. Raycus runs closer to 12-15%. This doesn’t make Raycus bad—at 40% lower cost, higher failure rates might be economically rational depending on your downtime costs and service capability.

CNC controllers from Siemens, NUM, Fanuc, Beckhoff, and Cypcut have different strengths. Siemens and NUM excel at complex multi-axis coordination. Cypcut costs less for 2D cutting applications. Controller choice affects programming complexity, available features, and whether you can hire operators familiar with the interface.

Servo motors from Mitsubishi, Yaskawa, and Siemens determine acceleration capability and positioning accuracy. Budget manufacturers use lower-cost Chinese servos that meet static specifications but have worse thermal stability and shorter bearing life. The difference shows up after 2,000-3,000 operating hours when positioning accuracy degrades on machines with budget servos.

Multi-sourcing maintains relationships with backup suppliers for critical components. This costs more—qualifying suppliers and maintaining relationships without guaranteed volume. But it reduces risk when your primary supplier has problems.

Ask manufacturers about backup sources for laser generators and CNC systems. Most have never qualified backup suppliers because it’s expensive and time-consuming. When shortages occur—like the 2021 semiconductor crisis—they have no alternatives.

The 2021 chip shortage extended laser equipment lead times by 3-6 months because CNC controllers use industrial microcontrollers. Manufacturers with buffer inventory and backup suppliers maintained shorter lead times. Those operating just-in-time with single sources faced severe delays.

China-centric supply chains face concentration risk. U.S. export controls, shipping disruptions, and political tensions affect component availability. European manufacturers sourcing from Asia faced 8-12 week shipping delays during the 2021 Suez Canal blockage.

Diversified procurement across regions reduces geographic risk but increases complexity and cost. Manufacturers balance risk reduction against operational efficiency based on their assessment of geopolitical stability. My view: geographic concentration risk is higher now than any time since the 1980s, but most manufacturers haven’t adjusted sourcing strategies.

Service capability determines equipment uptime over 10-15 year life. Purchase price accounts for 30-40% of total cost of ownership. Service, spare parts, and downtime make up the rest.

Mazak’s iCONNECT provides remote diagnostics—service engineers access machine data, review alarm histories, and diagnose problems without traveling. This reduces repair time from days to hours for software and parameter issues.

Regional service centers stock spare parts and deploy local technicians. Trumpf maintains service centers in 30+ countries. Machine failure? Local technicians arrive within 48-72 hours with common parts. Budget manufacturers rely on factory engineers flying from headquarters. International travel adds 3-7 days to response time and increases costs substantially.

Some manufacturers use authorized service partners. Partner quality varies wildly. I’ve seen partners that are better than factory service and partners who barely understand the equipment. Ask for partner references in your region and verify their capabilities independently.

24-hour telephone support sounds good. But is it engineers who understand machine operation or call center staff reading from scripts? Test this during evaluation—call with technical questions and assess response quality.

48-72 hour on-site service guarantees specify when technicians arrive, not when machines run again. If the technician shows up without the correct spare part, your machine stays down until parts ship from the factory. Professional manufacturers stock common parts regionally. Budget operations ship everything from a central warehouse.

Read service contracts carefully. Some guarantee response time, others guarantee resolution time. There’s a huge difference. Response time means someone contacts you within X hours. Resolution time means the machine is running within X hours. Most contracts specify response time only.

Parts availability affects repair time more than technician response speed. Local warehousing places fast-moving parts (protective windows, nozzles, sensors) in regional distribution. These are consumables you’ll replace regularly.

Slow-moving parts (laser sources, CNC control modules, ball screws) typically stock centrally because each unit costs $20,000-$100,000. The question is whether the manufacturer maintains buffer inventory or orders components only when needed.

I’ve seen laser source failures where budget manufacturers needed 8-12 weeks to obtain replacements from IPG because they had no buffer inventory and IPG had no stock. Professional manufacturers maintain backup sources or provide loaner units while repairing yours. This costs them money but prevents extended customer downtime.

On-site installation should include 3-5 days operator training, not just machine setup. Operators need beam alignment, focus calibration, and routine maintenance procedures. Budget manufacturers install equipment and leave. Your operators figure out operation through trial and error.

Certification programs validate that personnel understand safety and basic troubleshooting. Some manufacturers offer tiered certification (basic operator, advanced programmer, maintenance technician). Most provide no formal training program.

Preventive maintenance training teaches your staff routine service without factory support. This includes laser source cleaning, optical alignment verification, and motion system calibration. Manufacturers who insist on factory service for routine maintenance increase your long-term costs and create unnecessary dependencies.

Environmental practices affect operating costs significantly. Energy efficiency improvements can reduce costs by 30-40% over equipment life, making this a practical concern rather than just environmental responsibility.

Fiber lasers draw approximately 18kW total power to deliver 6kW cutting power: laser source (8-9kW), chiller (5-6kW), motion control (2-3kW), auxiliaries (2-3kW). Wall-plug efficiency runs about 33%.

CO2 lasers need approximately 100kW for equivalent 6kW cutting performance. The laser itself has 10-15% efficiency, plus chillers and gas circulation systems. Fiber laser adoption reduces energy costs by 80% compared to CO2.

Calculate 10-year energy costs during procurement. At $0.12/kWh and 4,000 operating hours annually:

Energy costs exceed purchase price differences between fiber and CO2 technology. This is why fiber lasers displaced CO2 in most metal cutting applications—economics, not environmental concerns.

Nesting software quality affects material utilization. Advanced software achieves 95%+ efficiency on sheet metal. Budget software runs 85-90%. The 5-10% difference matters significantly at volume production.

Run 1,000 sheets annually at $200/sheet. Poor nesting wastes $10,000-$20,000 annually in material costs plus disposal expenses. Software quality varies dramatically between manufacturers but rarely appears in specifications.

Coolant recycling extends replacement intervals from monthly to annually. This reduces disposal costs and environmental impact. Budget machines use once-through cooling, increasing operating costs and waste generation. Nobody mentions this during sales presentations, but it affects your operating budget.

ISO 14001 requires systematic environmental management, but implementation depth varies. Some manufacturers get certified to check boxes on RFPs. Others actually track energy consumption, set reduction targets, and invest in efficiency.

Carbon neutrality commitments from manufacturers help customers meet Scope 3 emissions reporting requirements. Amada joined RE100, committing to 100% renewable electricity. As carbon pricing expands globally, supplier environmental performance affects your reporting obligations and potentially carbon tax exposure.

I’m skeptical of most environmental marketing. But energy efficiency is pure economics. A machine consuming 30% less power saves you real money regardless of your environmental position.

Systematic evaluation helps compare manufacturers objectively and documents decisions for management. Procurement based on lowest price typically delivers higher total cost of ownership.

Assign weights based on your priorities:

Score each manufacturer 1-10 in each category. Multiply by weight and sum for total score. This quantifies subjective assessments.

Adjust weights for your situation. Need multiple machines quarterly? Increase production capacity to 25%, reduce sustainability to 5%. Regulated industry? Bump quality systems to 35%. The framework is a tool, not a formula—use it to structure thinking, not replace judgment.

Equipment calibration: Check calibration certificates for measurement equipment. Verify schedules match manufacturer recommendations. Look for expired calibrations—clear indicator of poor quality system implementation.

Process documentation: Review assembly procedures, test protocols, inspection checklists. Documentation should be detailed enough that trained technicians can build machines without verbal instruction. Vague procedures indicate informal processes that vary by operator skill.

Employee training records: Verify assemblers and inspectors have documented training and competency verification. ISO 9001 requires this, but implementation varies. Missing records mean quality depends on whoever shows up that day.

Environmental controls: Measure actual temperature and humidity in assembly areas during visits. Specified ±1°C control requires continuous monitoring and adjustment, not just HVAC installation. Bring a temperature logger and leave it overnight if possible.

Calculate 10-year TCO including:

Total 10-year cost typically runs 2.5-3.5x purchase price. Lowest purchase price rarely means lowest TCO. Service capability and energy efficiency matter more than $20,000-$30,000 purchase price differences.

Financial stability: Request financial statements. Manufacturers in financial distress cannot invest in service infrastructure or honor warranties. Multiple Chinese laser manufacturers closed since 2020—their customers are struggling to source spare parts.

Geopolitical supply chain risks: Assess exposure to trade restrictions and shipping disruptions. U.S.-China tensions have increased lead times and costs for manufacturers in both countries. I honestly don’t know how this evolves, but concentration in either geography creates risk.

Technology obsolescence: Evaluate manufacturer’s R&D capability and product roadmap. Technology moves fast—fiber lasers displaced CO2 lasers across most applications in roughly 10 years. Will your manufacturer support future requirements? Their R&D investment indicates whether they’re innovating or coasting.

Start with 1-2 units before volume commitments. This validates equipment performance, service response, parts availability, and training quality through actual operation.

Phase production ramp-up based on results. Order 2 units, operate 6 months, then order 5 more if performance meets expectations. This reduces risk compared to ordering 10 units based on sales demonstrations.

Contract terms can specify performance milestones: “Order 10 additional units if first 3 machines achieve 95% uptime over 6 months with maximum 48-hour repair time.” This aligns incentives and protects you if performance falls short.

OPMT’s ODM process follows five phases: requirements analysis, design validation through engineering review, pilot production, mass production qualification, and scaled production with ongoing monitoring. This systematic approach works for customers and demonstrates how manufacturers should engage with custom applications.

Factory selection matters more than most procurement teams realize. Infrastructure quality, production capability, quality management maturity, R&D depth, supply chain resilience, and service networks all affect long-term success far more than specification differences between machines.

Professional manufacturers cost more initially but deliver better value through higher reliability, stronger support, and lower operating costs. Budget manufacturers look attractive on purchase price but often cost more over equipment life through downtime, poor support, and higher energy consumption.

Document your evaluation using structured frameworks. This provides decision rationale for management and creates reference methodology for future equipment purchases. Organizations that evaluate suppliers systematically make better decisions and get better results.

For additional research on manufacturers and their capabilities, see laser metal cutting machine suppliers and laser cutting manufacturers.

Disclaimer

This content is compiled by OPMT Laser based on publicly available information for reference only; mentions of third-party brands and products are for objective comparison and do not imply any commercial association or endorsement.

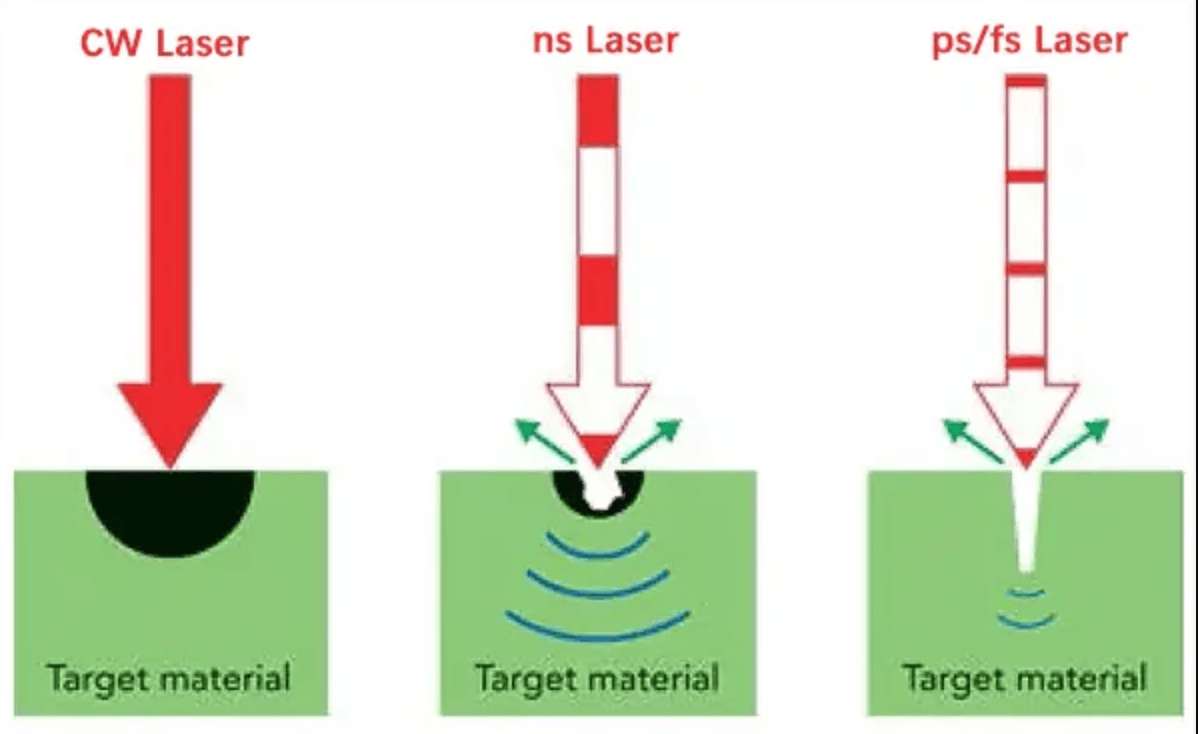

Compare picosecond vs nanosecond laser systems for industrial manufacturing. HAZ data, processing speeds, cost analysis, and application criteria from OPMT’s deployed systems.

PCD laser cutting machines deliver 0.003mm accuracy and 3x faster processing than EDM. Complete technical guide to polycrystalline diamond tool manufacturing for aerospace and automotive industries.

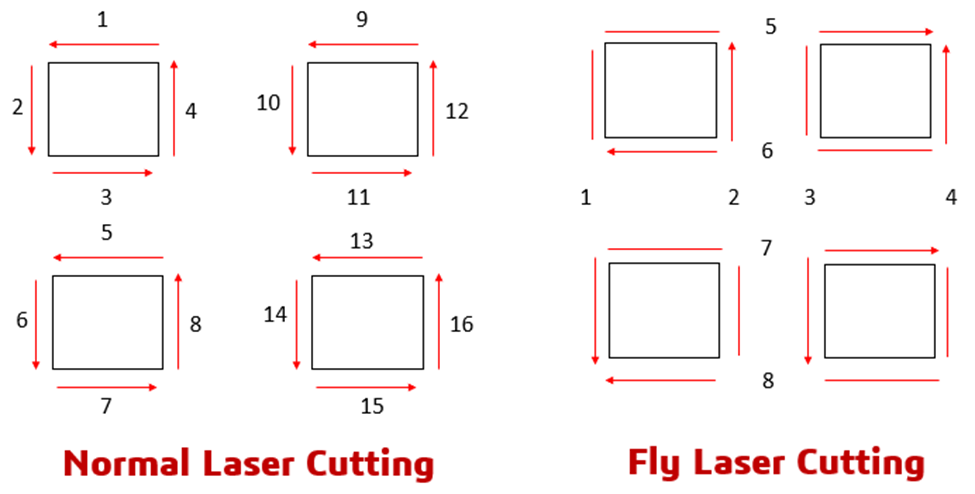

Fly cut laser technology reduces cycle time by 30-50% through continuous motion path optimization. Learn mechanics, applications, and OPMT equipment specifications for precision manufacturing.

Compare top 5-axis CNC machine manufacturers including DMG MORI, Mazak, and OPMT Laser. Technical specs, pricing tiers, and application guide for aerospace, automotive, and medical device industries.

Please fill in your contact information to download the PDF.