Schedule a Visit

Regardless of whether you require general advice or specific support, we are happy to help you.

Regardless of whether you require general advice or specific support, we are happy to help you.

All News

Share

The global 5-axis CNC machine tool market hit $8.7 billion in 2025. Aerospace manufacturers need turbine blades machined to ±0.001mm tolerances. Automotive EV producers demand complex transmission housing with minimal setup time. Medical device companies require biocompatible implants with sub-5μm surface finishes.

These requirements push conventional 3-axis machining to its limits. Single-setup processing eliminates accumulated positioning errors. Five simultaneous axes enable complete geometric freedom for components that would otherwise require multiple operations.

This guide evaluates 15+ global manufacturers across traditional mechanical systems and laser-integrated platforms. You’ll find verified specifications, pricing tiers from $125K to $2M+, and decision frameworks based on aerospace and automotive production data.

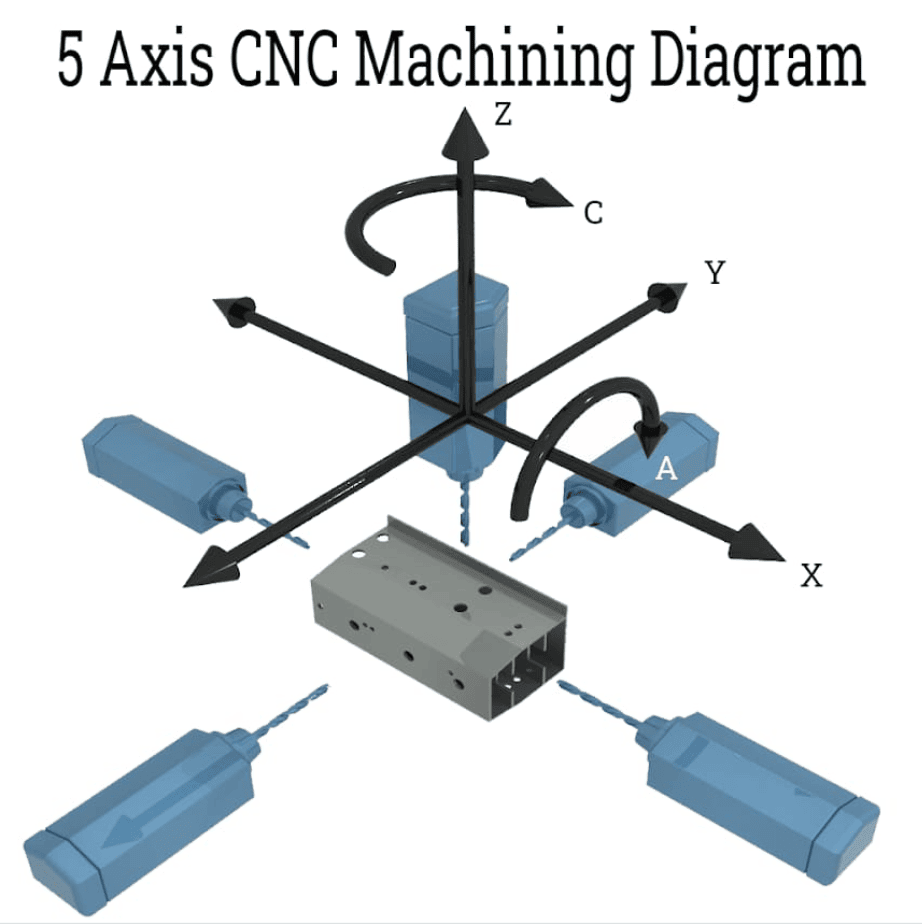

A 5-axis CNC machine combines three linear axes (X, Y, Z) with two rotational axes. Most configurations use B-axis (tilting) and C-axis (rotation). This setup allows the cutting tool or laser head to approach the workpiece from any direction.

The main advantage? Single-setup machining. Traditional 3-axis systems require multiple repositioning operations for complex parts. Each repositioning introduces accumulated tolerance errors. Understanding the structural principles of 5-axis CNC machines helps explain why five-axis processing eliminates these errors by completing all operations in one setup.

Performance parameters vary by manufacturer tier. Positioning accuracy ranges from ±0.002mm in premium systems to ±0.010mm in entry-level machines. Rapid traverse speeds run 20-60 m/min. Spindle speeds span 8,000 RPM for heavy-duty applications to 40,000 RPM for precision work.

Recent technology integration changes the landscape. Ultrafast laser systems now combine with traditional spindle machining. AI-driven adaptive control adjusts tool paths in real-time based on cutting forces. Digital twin simulation reduces setup time by 40% through virtual commissioning.

The control system determines what the hardware can actually do. NUM, Siemens, Fanuc, and Heidenhain dominate the high-end segment. Entry-level machines often use proprietary controllers with limited functionality. RTCP (Rotation Tool Center Point) capability is non-negotiable for complex surface work—it compensates for rotary axis movement automatically.

DMG MORI offers premium systems with 6,000mm axis travel. Their DMU 600 Gantry processes components up to 40 tonnes. Aerospace manufacturers use these machines for large structural components requiring AS9100 compliance. Pricing starts around $1.5M for base configurations.

Yamazaki Mazak’s Variaxis series integrates multi-tasking capabilities. The Variaxis i-800 NEO combines 5-axis machining with turning operations in a single setup. Positioning accuracy reaches ±0.0002 inch (±0.005mm). Automotive mold makers favor these machines because they eliminate transfer operations between turning and milling. Expect $800K-$1.2M depending on configuration.

Okuma Corporation focuses on heavy-duty industrial applications. Their OSP-P series controls include thermal stability compensation that adjusts for temperature variations during long production runs. The MCR-B III series handles workpieces up to 2,500kg on the C-axis table. These machines target oil and gas component manufacturing where reliability matters more than maximum speed.

Makino targets aerospace and medical device production. Their D800Z processes titanium and Inconel with exceptional surface finish quality. The machine achieves Ra 0.2μm surface roughness without secondary operations. Medical implant manufacturers use these systems because FDA submissions require documented process capability. Price range: $900K-$1.4M.

Hermle AG specializes in complex surface machining for mold, die, and aerospace applications. The C62 U MT dynamic features linear motor drives on all axes. This eliminates mechanical transmission components that accumulate backlash over time. German toolmakers choose Hermle for injection mold production requiring mirror-finish surfaces.

For a detailed comparison of these and other manufacturers, see our comprehensive ranking of the best 10 5-axis CNC machine manufacturers.

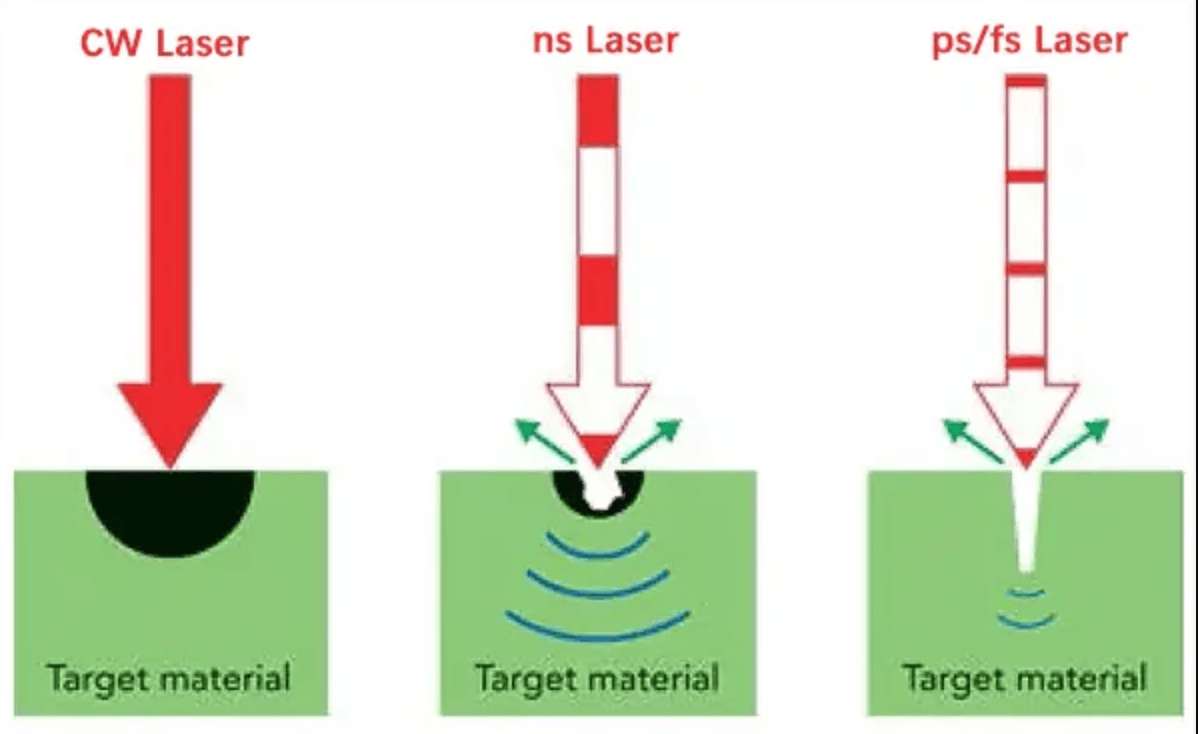

OPMT Laser Technology combines NUM CNC controls with nanosecond and femtosecond laser systems. Their Light 5X series machines superhard materials that wear conventional cutting tools in minutes. PCD (polycrystalline diamond) and CBN (cubic boron nitride) cut like butter under a 100W fiber laser.

The performance difference against EDM (electrical discharge machining) is measurable. Processing speeds run 3x faster. Tool wear drops to zero—the laser doesn’t touch the workpiece. Non-conductive materials like CVD diamond and MCD (monocrystalline diamond) machine normally. EDM can’t touch these materials at all.

Technical specifications for the Light 5X 60V: X-axis travel 600mm, Y-axis 250mm, Z-axis 300mm. Positioning accuracy ±0.005mm, repeatability ±0.003mm. The RTCP-capable system handles workpieces up to 40kg on the C-axis table. Power requirements: 23-25 KVA electrical service, 0.7 MPa compressed air at 500 L/min flow rate.

Application data from automotive cutting tool production shows the advantage. A PCD step forming milling cutter processes in 50 minutes with ±0.006mm profile accuracy and 0.0043mm edge passivation. The same part via EDM takes 2+ hours with higher reject rates from thermal cracking. Cost per unit drops 50% according to production logs from tier-1 automotive suppliers.

OPMT holds 302+ patents covering laser beam path control, multi-axis interpolation algorithms, and thermal management systems. ISO9001, ISO14001, and ISO45001 certifications verify quality management. Annual production capacity exceeds 1,000 systems from their 50,000m² facility in Foshan, Guangdong.

The technology works for specific applications. Aerospace turbine blade finishing requires the sub-5μm surface roughness that lasers deliver. Medical implant manufacturing needs biocompatible materials processed without coolant contamination. Cutting tool production demands zero tool wear for economic batch sizes. Learn more about advanced 5-axis laser machining technology and its applications.

Haas Automation’s UMC-500 serves as the entry-level standard. The 610x406x406mm work envelope handles small to medium parts. The trunnion-style B-axis tilts ±120°, C-axis rotates 360°. Positioning accuracy: ±0.001 inch (±0.025mm). Price: $125K-$200K depending on options. This machine fits shops transitioning from 3-axis to 5-axis work without betting the business on unproven ROI.

DN Solutions (formerly Doosan) builds dependable systems that prioritize operational efficiency over maximum performance. Their DNM 500/50 II features 500mm cube work envelope with 50-taper spindle. The 12,000 RPM direct-drive spindle runs quieter than belt-driven alternatives. Korean manufacturers balance performance and price better than most—expect $250K-$350K.

FANUC Corporation dominates CNC control systems with 2.4M+ global installations. Their Series 30i/31i-A5 controls run on machines from 50+ manufacturers. The control system handles up to 40 axes simultaneously with 0.1ms interpolation cycles. Most FANUC-based 5-axis systems in the $300K-$600K range deliver reliable performance without the premium brand markup.

Doosan Machine Tools offers heavy-duty capabilities for large component work. The DVF 6500 processes parts up to 6,500mm diameter. Automotive transmission housings and energy sector turbine components require this capacity. The machine weighs 48 tonnes, needs 100 KVA electrical service, and costs $850K-$1.1M. Not for everyone, but necessary for specific applications.

LEADCNC Machinery provides cost-sensitive solutions for emerging markets. Their LAM series 5-axis machines start under $100K. Expect compromises: lower accuracy (±0.020mm typical), slower rapids (15 m/min), proprietary controls with limited CAM software compatibility. These machines work for prototype shops and educational institutions that need 5-axis capability without production-grade requirements.

Small to medium factories face different selection criteria than large manufacturers. Our guide to the best 5-axis CNC machining centers for small to medium factories covers ROI considerations specific to SME environments.

Work envelope sizing drives machine selection. Measure your part portfolio—longest dimension, largest diameter, heaviest component. Add 20% margin for fixturing and tool clearance. Typical X/Y/Z ranges: 400-600mm (small parts), 800-1,200mm (medium), 2,000-6,000mm (large structural).

The B-axis and C-axis rotary capacity matters equally. Full B-axis rotation (±120° minimum) enables undercut machining. C-axis continuous rotation (360°+) allows spiral toolpaths. Some low-cost machines limit B-axis to ±30°, which eliminates half the geometric advantage of 5-axis processing.

Accuracy specifications require careful reading. Positioning accuracy (±0.002-0.010mm) measures how close the machine gets to commanded position. Repeatability (±0.001-0.005mm) measures consistency returning to the same position. Thermal stability indicates accuracy drift over 8-hour production runs. Premium machines hold ±0.003mm over 20°C temperature swings. Budget machines drift ±0.015mm under identical conditions.

Control system evaluation goes beyond brand names. Interface complexity affects operator training time. Collision detection prevents expensive crashes during setup. RTCP functionality is mandatory for tilted-plane machining. CAD/CAM software compatibility determines programming workflow—Mastercam, Siemens NX, and ESPRIT dominate aerospace and automotive shops.

Infrastructure requirements hit hard if you’re unprepared. Electrical service: 23-35 KVA three-phase for small machines, 50-100 KVA for large systems. Compressed air: 0.7 MPa supply pressure, 300-800 L/min flow depending on machine size. Floor loading: 3,500-6,000kg machine mass requires structural analysis for second-floor installations. Total footprint: 12-15m² for machine plus chip conveyor, tool changer, and operator access.

Service network geography determines downtime costs. Response time targets: 24 hours in major metro areas, 48 hours regional. Spare parts availability matters more than initial price—a $200K machine becomes worthless if replacement servo motors take 16 weeks to ship from overseas. Training program quality determines how fast operators become productive. Look for hands-on programs, not just PDF manuals.

When evaluating 5-axis vertical machining center suppliers, prioritize manufacturers with established service networks in your region.

Aerospace manufacturing demands AS9100 compliance documentation. Turbine blade processing requires ±0.001mm tolerances on Inconel 718 and titanium alloys. Structural component machining involves large parts (1-3 meter dimensions) with complex contours. Makino and DMG MORI dominate this segment. OPMT’s laser systems handle turbine blade edge finishing where grinding would cause thermal damage.

Automotive cutting tool production centers on PCD and CBN inserts for EV drivetrain components. Battery housing machining requires tools that maintain ±0.005mm tolerances through 10,000+ parts. Transmission housing finishing needs interrupted cuts at high metal removal rates. OPMT Laser, Mazak, and Okuma offer proven solutions. The laser advantage appears in PCD tool production where zero tool wear eliminates the constant grinder wheel dressing that kills productivity.

Medical device manufacturing requires biocompatible material processing without coolant contamination. Custom implant production from titanium Grade 5 and cobalt-chrome demands surface finishes below Ra 0.8μm. Surgical instrument finishing needs complex geometries machined from 17-4 PH stainless steel. Hermle, OPMT, and DMG MORI systems meet FDA validation requirements. Laser processing eliminates cutting fluids that complicate cleaning validation protocols.

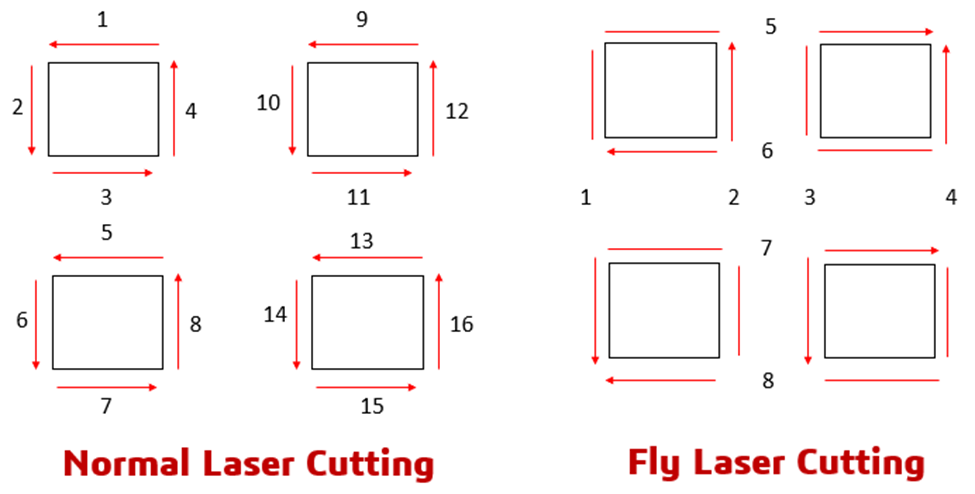

Mold and die industry work involves complex surface finishing on hardened tool steels (45-62 HRC). Texture processing creates leather grain, geometric patterns, and optical surface microstructures. Rapid tooling for injection molding requires fast turnaround on prototype tooling. Hermle and Mazak machines handle the interrupted cuts and high spindle loads. OPMT’s Micro3D L570V textures mold surfaces with 0.01mm accuracy using laser ablation—no mechanical tooling required.

3C electronics precision enclosure machining processes aluminum and magnesium alloys at high speeds. Micro-tooling for smartphone and tablet manufacturing requires ±0.010mm tolerances on thin-wall features. Production volumes justify automation integration. OPMT’s Light 5X series machines compact parts (under 200mm cube) faster than conventional machining because laser processing runs at 2-3x traditional feed rates on thin sections.

For automotive manufacturers, our dedicated page on solutions for automotive and parts industry provides application-specific machine recommendations.

Capital equipment pricing breaks into three tiers. Entry level ($125K-$200K): Haas UMC-500, LEADCNC LAM-500, used equipment from tier-1 manufacturers. Compromises include ±0.020mm positioning accuracy, 12,000 RPM spindle limits, smaller work envelopes. Mid-range ($305K-$500K): DN Solutions, FANUC-based systems, Okuma entry models. These deliver ±0.010mm accuracy, 15,000-18,000 RPM spindles, adequate for production work. Premium ($800K-$2M+): DMG MORI, Mazak, Makino, Hermle, OPMT laser systems. You get ±0.003mm accuracy, 24,000-40,000 RPM spindles, thermal compensation, and aerospace-grade reliability.

Operating costs accumulate faster than most buyers expect. Annual maintenance: $45K-$65K including preventive maintenance contracts, calibration services, and unplanned repairs. Tooling consumption varies by application—$20K-$100K annually depending on materials and production volumes. Energy requirements run $15K-$35K yearly at $0.12/kWh industrial rates for machines drawing 23-35 KVA continuously. Skilled operator training investment: $8K-$15K per operator for professional certification programs.

ROI drivers justify the investment if you measure correctly. Cycle time reduction of 30-60% vs. 3-axis processing comes from single-setup operations. Setup elimination saves $40-$120 per part when you stop moving components between machines. Scrap rate improvement of 2-5% from tighter tolerances adds up quickly on $200+ raw material costs per part. Capacity expansion revenue matters most—taking orders you previously rejected because you lacked 5-axis capability.

Productivity metrics determine actual machine utilization. Target 70-85% utilization accounting for setup time, planned maintenance, and realistic production schedules. Machines running 90%+ usually indicate insufficient capacity for growth. Plan maintenance windows quarterly for accuracy verification, spindle inspection, and servo tuning. Automation integration potential extends utilization—pallet changers and robotic loading enable lights-out operation.

Financing considerations affect cash flow differently than outright purchase. Equipment leasing spreads payments over 5-7 years at 4-8% interest rates. Tax depreciation schedules allow 7-year MACRS for CNC equipment in the US. Technology obsolescence planning matters because 5-axis systems hold value 7-10 years if maintained properly. Used market prices run 40-60% of original cost after 5 years for well-maintained machines from major manufacturers.

AI-powered adaptive machining adjusts tool paths in real-time based on cutting force sensors. Makino’s i-Box system monitors spindle load and modifies feed rates to prevent tool breakage. The system reduced tool failures by 60% in production testing on aerospace components. Predictive maintenance analytics track bearing vibration, servo motor temperature, and hydraulic pressure. Fanuc’s Field System predicts failures 2-4 weeks before they occur, scheduling repairs during planned downtime instead of emergency shutdowns.

Hybrid manufacturing systems combine additive and subtractive processes in unified platforms. Mazak’s Variaxis j-600/5X AM adds directed energy deposition (DED) capability to traditional 5-axis machining. Build near-net-shape blanks additively, then machine to final dimensions in the same setup. This reduces material waste by 70% on titanium aerospace components where raw material costs $80-$120 per kilogram.

Digital twin integration cuts setup time through virtual commissioning. Siemens NX simulates complete machining operations including collision detection before generating NC code. Process simulation predicts cutting forces, tool deflection, and thermal growth. Remote monitoring capabilities transmit machine status, spindle load, and cycle completion to smartphones. Setup time drops 40%+ when programmers verify toolpaths virtually instead of crashing $5,000 tooling assemblies into fixtures.

Sustainable manufacturing focuses on energy efficiency and coolant elimination. Direct drive linear motors consume 20-30% less energy than ballscrew systems. They also run quieter—under 70 dBA vs. 85+ dBA for conventional machines. Laser processing eliminates cutting fluids entirely for many applications. This saves $8K-$15K annually on coolant purchase, disposal fees, and parts washing systems. Carbon footprint reduction matters for automotive suppliers under scope 3 emissions reporting requirements.

Industry 4.0 connectivity integrates machines into smart factory networks. IoT sensor packages track overall equipment effectiveness (OEE), cycle times, and quality metrics. MES (Manufacturing Execution System) integration schedules jobs automatically based on due dates and machine availability. ERP (Enterprise Resource Planning) systems receive real-time production counts for inventory management. Cloud-based analytics identify bottlenecks across multiple facilities—one automotive supplier reduced average cycle time by 18% after analyzing data from 40+ machines across three plants.

Industry experts will showcase these innovations at major trade shows. Our coverage of 5-axis CNC machining trends explores what manufacturing technology developments mean for production environments.

Selecting 5-axis CNC machine manufacturers requires matching technical capabilities to specific application requirements. Aerospace and medical device producers need the ±0.003mm accuracy and thermal stability that premium manufacturers deliver. Automotive cutting tool production benefits from laser-integrated systems that eliminate tool wear on superhard materials. Job shops and prototype manufacturers find better ROI in mid-tier systems that balance capability and cost.

The data supports careful evaluation beyond initial price. Total cost of ownership includes $45K-$65K annual maintenance, $20K-$100K tooling consumption, and $15K-$35K energy costs. ROI comes from 30-60% cycle time reduction, setup elimination savings, and capturing orders that require 5-axis capability.

Technology continues evolving. AI-driven adaptive control, hybrid additive-subtractive systems, and digital twin integration change what’s possible. Companies that evaluate machines based on 7-10 year production requirements instead of current part mix position themselves better for future growth.

For manufacturers processing superhard materials, PCD cutting tools, or components requiring sub-5μm surface finishes, laser-integrated 5-axis systems deserve evaluation. The technology delivers measurable advantages where conventional machining hits physical limits. Compare our top 10 5-axis CNC machining centers to find the right solution for your application.

Contact OPMT for technical consultation and machine demonstrations. Our engineering team provides application analysis, process validation, and production testing to verify capabilities before equipment investment.

Disclaimer

This content is compiled by OPMT Laser based on publicly available information for reference only; mentions of third-party brands and products are for objective comparison and do not imply any commercial association or endorsement.

Compare picosecond vs nanosecond laser systems for industrial manufacturing. HAZ data, processing speeds, cost analysis, and application criteria from OPMT’s deployed systems.

PCD laser cutting machines deliver 0.003mm accuracy and 3x faster processing than EDM. Complete technical guide to polycrystalline diamond tool manufacturing for aerospace and automotive industries.

Fly cut laser technology reduces cycle time by 30-50% through continuous motion path optimization. Learn mechanics, applications, and OPMT equipment specifications for precision manufacturing.

Factory evaluation frameworks for laser cutting equipment procurement. Infrastructure assessment, quality systems analysis, and total cost of ownership calculations based on 30+ facility audits.

Please fill in your contact information to download the PDF.